Property is an exceptional asset class. It profits from capital growth as well as cash from rental yields. Not to mention the inherent utility associated with owning an apartment or land. But investing in properties outright requires significant capital outlay as well as intense time management from investors. As a result, there are now property funds that exist to remove such hurdles from the equation, whilst delivering property-like performance. We will look at them in detail here.

What is a property fund?

Property funds are collective investment schemes, which pool capital from a group of investors and then invest in the desired assets (i.e. real estate holdings). In these situations, individual investors become shareholders of a special purpose vehicle (SPV) that holds the said properties. This is a form of indirect ownership. Any return (rent or capital gain) generated by properties needs to be passed through the SPV first before being paid to investors (usually in the form of dividends).

Property funds generate returns from different sources:

- Rental income through equity ownership

- Capital gains through equity ownership

- Mortgage interest payment through debt instruments

- A hybrid equity-debt return profile

Equally, property funds can be publicly traded or private. This simply affects the liquidity of the fund rather than its underlying asset value.

Are there any REITs in Switzerland?

Since being established in the US in 1960, a specific type of property fund called a Real Estate Investment Trust (REIT), has proven popular with investors attracted to the favourable tax treatment and high liquidity (being publicly traded) such funds gain from.

However, REITs do not exist per se in the Swiss market. Instead, there are many funds (mostly mutual funds and ETFs) that mimic the effect of REITs and are publicly traded on SIX. We will examine them in detail.

Top 10 Swiss property funds (REIT equivalents)

CS (CH) Swiss Real Estate Securities Fund (ETF)

TER (Total Expense Ratio): 1.5%

Performance (yearly): 8.5%

Yield: N/A

Maximum drawdown*: -38%

An ETF that tracks the SXI Swiss Real Estate® TR. Index and is diversified across the residential, commercial and industrial sectors.

CS Real Estate Fund Green Property (Mutual fund)

TER (Total Expense Ratio): 0.7%

Performance (yearly): 9.9%

Yield: N/A

Maximum drawdown*: -90%

A mutual fund that invests directly in RE projects with a green and sustainable mandate.

CS Real Estate Fund Interswiss (Mutual fund)

TER (Total Expense Ratio): 1%

Performance (yearly): 5.4%

Yield: 3.9%

Maximum drawdown*: -98%

A mutual fund that invests primarily in commercial and highly sought-after residential properties.

CS Real Estate Fund Hospitality (Mutual fund)

TER (Total Expense Ratio): 0.6%

Performance (yearly): 5.0%

Yield: N/A

Maximum drawdown*: -35%

A mutual fund that focuses on the hospitality and healthcare sector in Switzerland.

CS Real Estate Fund Siat (Mutual fund)

TER (Total Expense Ratio): 0.7%

Performance (yearly): 6.0%

Yield: 2.7%

Maximum drawdown*: -95%

This mutual fund invests in multi-family dwellings and commercial buildings (and then let to prime tenants on a long-term basis.

CS Real Estate Fund LivingPlus (Mutual fund)

TER (Total Expense Ratio): 0.7%

Performance (yearly): 4.3%

Yield: N/A

Maximum drawdown*: -89%

A mutual fund that invests in integrated senior residential housing in major Swiss cities to cater to the aging population.

UBS ETF (CH) SXI Real Estate® (ETF)

TER (Total Expense Ratio): 0.7%

Performance (yearly): 5.0%

Yield: N/A

Maximum drawdown*: -25%

An index ETF that focuses primarily on commercial and residential property funds in Switzerland. It incorporates many of the mutual funds listed above.

CS Fund 3 (ETF)

TER (Total Expense Ratio): 1.5%

Performance (yearly): 6.9%

Yield: N/A

Maximum drawdown*: -81%

An ETF similar to the UBS SXI Real Estate, albeit with a significantly higher TER and better long-term performance.

Swisscanto (CH) Real Estate Fund (Mutual fund)

TER (Total Expense Ratio): 1.33%

Performance (yearly): 6.9%

Yield: N/A

Maximum drawdown*: -9%

An actively managed fund with total exposure to the Swiss commercial and residential market. Its underlying assets include many of the mutual funds offered by UBS and Credit Suisse.

UBS AST Immobilien Schweiz (Closed-ended fund)

TER (Total Expense Ratio): 0.6%

Performance (yearly): 4.1%

Yield: N/A

Maximum drawdown*: -12%

A close-ended property fund that invests primarily in residential estates. Redemption is available on a monthly basis. Known for stable performance and low volatility.

* Max drawdown is the theoretical difference between the peak and trough valuations. This gives a good indication of the volatility level of different instruments. It provides a sense check to investors on their psychological tolerance of the volatility and whether it remains a suitable asset class for the investor. This is calculated using historical data since the inception of the given instrument.

The benefits of investing in Swiss property funds

Investing in Swiss property brings significant benefits to investors seeking steady capital returns.

- Geographical diversification: Switzerland is an advanced and neutral nation with an extremely well-developed financial service sector. It is a well-regarded safe haven for capital protection.

- Asset diversification: real estate is an alternative asset class to stocks and bonds. It can exhibit an uncorrelated return profile and offers a good hedge in the portfolio against adverse market conditions.

- Liquidity: all of the funds outlined above are publicly traded and thus highly liquid, which eliminates one of the main drawbacks of investing in properties.

- Steady passive income: many of these funds pay a dividend to investors and they have equally high payout ratio and consistency, making them a great addition to investors seeking passive income.

- High ROI: many of the funds above have consistently delivered circa double-digit ROI, which given the relatively low risk associated with the asset class, confers an excellent risk-adjusted return profile.

- Transparency and governance: public funds in Switzerland have stringent governance requirements and investors can be assured that their capital is highly unlikely to become corrupted.

The downsides of investing in Swiss property funds

Whilst property funds remain an attractive investment option in the right circumstances, we cannot overlook some serious downsides.

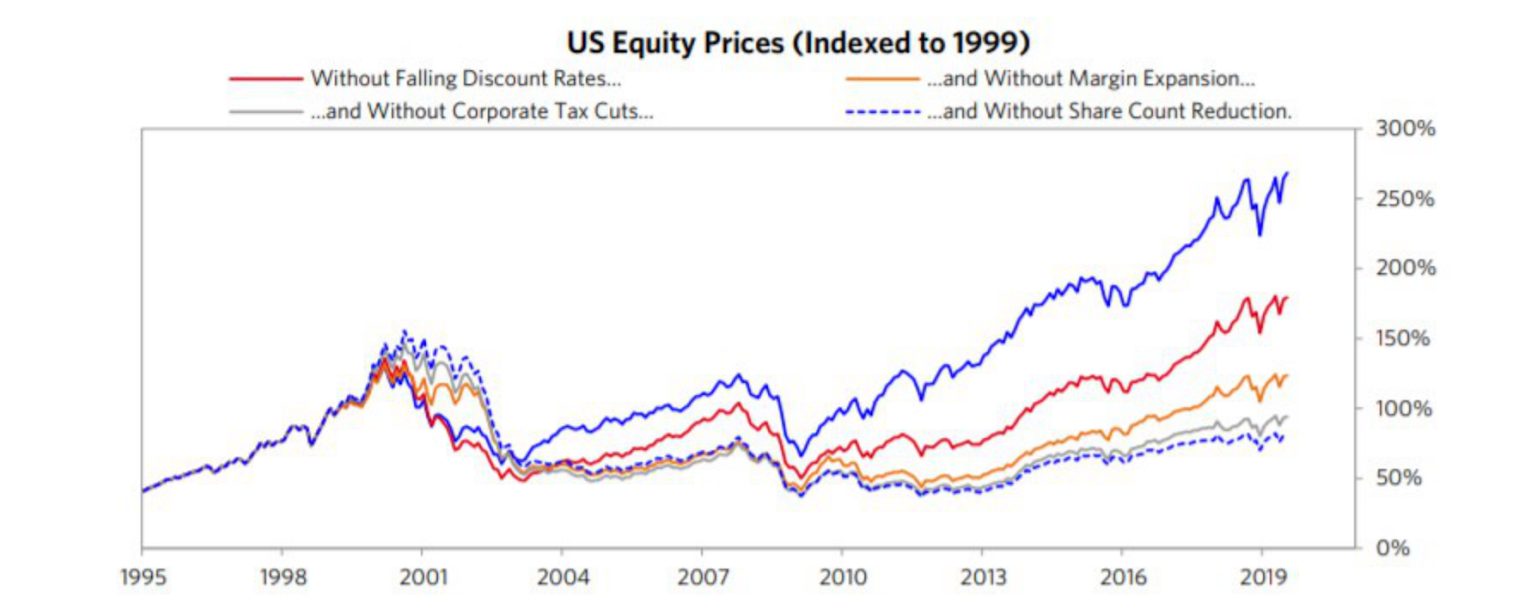

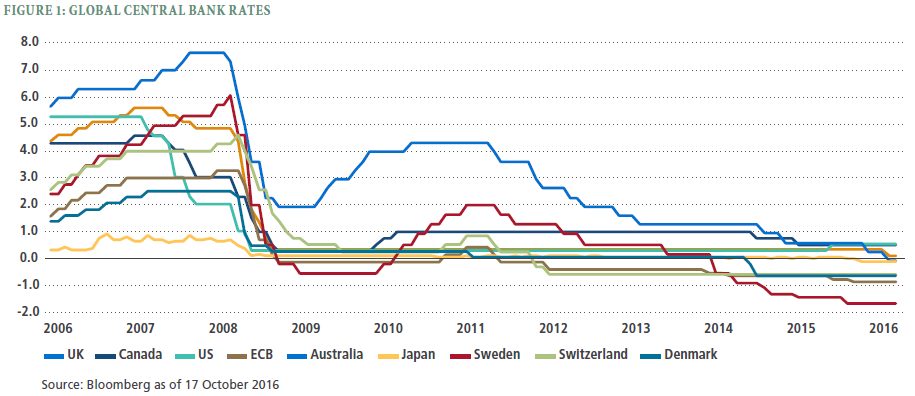

- Overvaluation: there are several fundamental factors that support the Swiss economy and its property sector. Although GDP growth, rising tourism and youthful demographics point to long-term stability and growth, we should not overlook the impact of negative interest rates on property valuations. The ultra-low rate has made it extremely cheap to borrow money and invest in other assets that will generate a higher return (e.g. property, except for ones that are under the radar of big players). As a result, a significant portion of the value uplift in property in the past decade can be apportioned to debt-fuelled investment choices. As Figure 1 illustrates below, most of the growth in the US lately can be attributed to favourable monetary and fiscal policies. And given how synchronized the rates are across developed economies (Figure 2), it is safe to extrapolate the trend to other countries. Consequently, the value inflation in the property sector erodes the margin of safety for investors and thus represents an undeniable headwind to return for investors.

- Management costs: properties require management. This is an undeniable fact. Whilst investors may not be directly paying for it, (out of their pocket regularly like a buy-to-let) these costs remain and are deducted from the invested capital. Additionally, fund managers themselves need to be paid. This is why property funds tend to have a higher Total Expense Ratio (TER) than stock or bond funds, which often exceed 1%. As we know, fees represent a serious erosion to investment value and thus investors need to question whether the higher TER levied, can be offset by superior performance.

- Speculative forces: property funds were originally created as a stable income instrument for risk-averse investors who wished to gain exposure to the real estate market. But since negative rates began turbocharging property valuations, such funds have become an instrument of capital gain play and all the masses of speculative investors seeking a quick return. This further pushes up the valuation and erodes the margin of safety, making it a less attractive asset class. Furthermore, we are on the edge of peak valuation and are approaching the next paradigm shift in the investment world. Consequently, blindly entering the market right now presents a high downside risk to your capital.

Figure 1. The effect of favourable monetary and fiscal policies on the US economy

(Source: Ray Dalio)

Figure 2. The synchronous interest rate movement across the developed economies since 2006

(Source: PIMCO)

How do you select the property fund that suits you?

There are literally hundreds of property funds around the world to choose from, so it is easy for investors to get lost in the noise. Yet there are a few key principles that, if stuck to, will protect investors from making avoidable and highly costly mistakes.

- Always choose a publicly listed fund: whilst private unlisted funds can be lucrative, they have poor liquidity and are not suitable for investors who wish to have quick access to their money. Publicly listed ones, on the other hand, can be sold quickly (ETFs are sold instantaneously during trading hours).

- Avoid cyclical sectors: some market sectors are more prone to the economic cycle (i.e. cyclical) than others. For example, shopping malls and luxury brands tend to perform well when the economy is rising, but poorly during recessions. On the other hand, residential units and healthcare properties perform well regardless of the larger economy and thus are more likely to deliver consistent returns.

- Seek out top performers: there are some funds that consistently outperform their peers. They are managed by industry leaders with a proven track record of delivering double-digit returns, (often for a decade or more) setting them apart from newcomers to the market.

- Avoid newbies: this is the inverse side of the coin for #3. Whilst past performance may not indicate the future, it is a telling indicator. Newcomers with no track record largely pose a greater risk and are therefore best avoided, unless an investor has a personal connection and deep conviction with the founder.

- Stay for the long-term: real estate has delivered excellent returns to investors over the past decades and thanks to the rising population and urbanisation, this is likely to continue. Yet the economy is cyclical and short-term fluctuations can make some investors go weak at the knees. Only with a long-run mentality can investors truly benefit from the tremendous powers property investment can bring.

The long view

Property funds can offer steady passive income combined with decent capital returns. But investors need to focus their objectives clearly and undertake a thorough analysis of the underlying assets by appraising how well aligned they are to his specific profile and goals.

Equally, one should not lose sight of the macroeconomic conditions and the effect of interest rates on property valuations. But when correctly executed, real estate remains a bountiful asset class that can be relied on in the long-run.

We also advise investors to familiarise themselves with other types of assets, as comparative insight can improve the likelihood of successful asset selection, thus making portfolio diversification a far smoother and less risky proposition.