Have a guess. Just imagine you’d invested $10,000 in Amazon when it first went public in 1997. So, what do you think the shares would be worth today? Yes, that’s right! Over $13,620,000!

You would comfortably belong to the category of the world’s wealthiest 1%. And you’d be part of an elite club, defined by financial freedom and a lifestyle worthy of royalty.

The lesson of this story is that financial markets do not discriminate between rich and poor. Anyone with a little cash can, with some professional knowledge and a bit of luck, buy assets which could potentially bring a cash windfall. The fundamental thing here, is to invest in the right stock at the right time and then stick with it until it fully matures.

So far in 2020 the companies below are the current top 10 Swiss stocks. But even here, tread with caution and read our handy tips on safely exploring the latest options, from the exciting but unpredictable world of stock investment.

The Top 10 Swiss stocks to watch in 2020

To qualify for this, we look for stocks that have shown tremendous growth in 2019 and which also have a large economic moat and/or trade barriers, which allow companies to hold on to their customers and protect the long-term profitability.

Lastminute.com (LMN)

Last year performance: 1,56

Peak-to-trough performance: -80%

A proven leader in the discounted and last-minute travel booking market that operates across Europe and owns several other prominent brands. We expect it to show continued revenue and EBITDA growth in the coming years as the travel market expands and it takes an increasing share.

Sonova (SOONE)

Last year performance: 1

Peak-to-trough performance: -39%

A global leader in the hearing aid market, accounting for 24% of trade in the segment, Sonova utilises advanced technology to deliver high-quality bionics that is hard to beat.

Idorsia (IDIA)

Last year performance: 0,94

Peak-to-trough performance: -39%

Idorsia is a pharmaceutical company that specialises in drug development for chronic illnesses (e.g. insomnia, hypertension, systemic lupus erythematosus). A strong moat has been built based around its drug pipeline, it is expected to perform well once regulatory approval has been obtained.

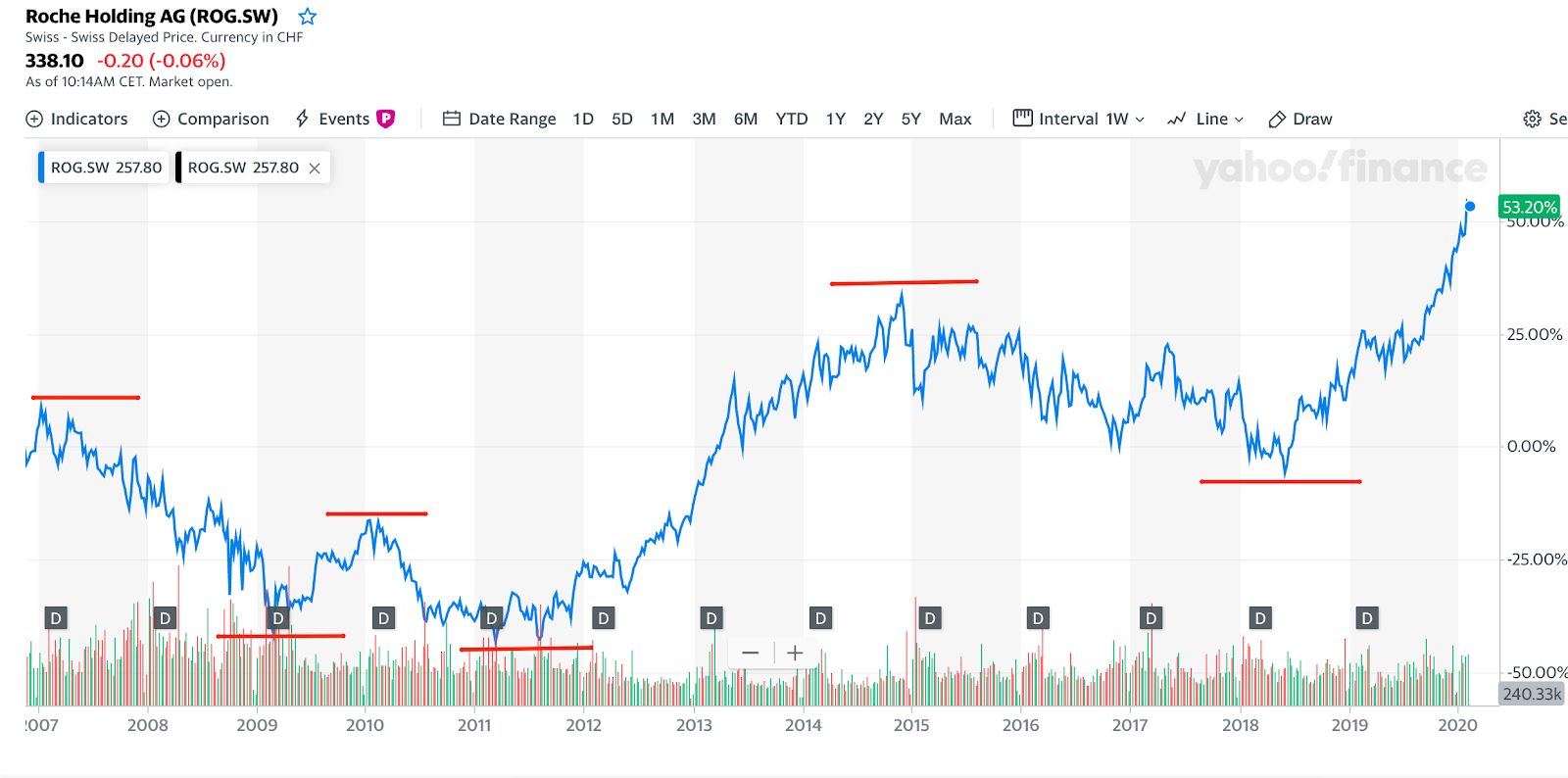

Roche Holding (ROG)

Last year performance: 23%

Peak-to-trough performance: -80%

A global leader in drug discovery and development, Roche enjoys unparalleled advantage and has a wide range of drug offerings for a variety of illnesses. It has grown both organically and through acquisition.

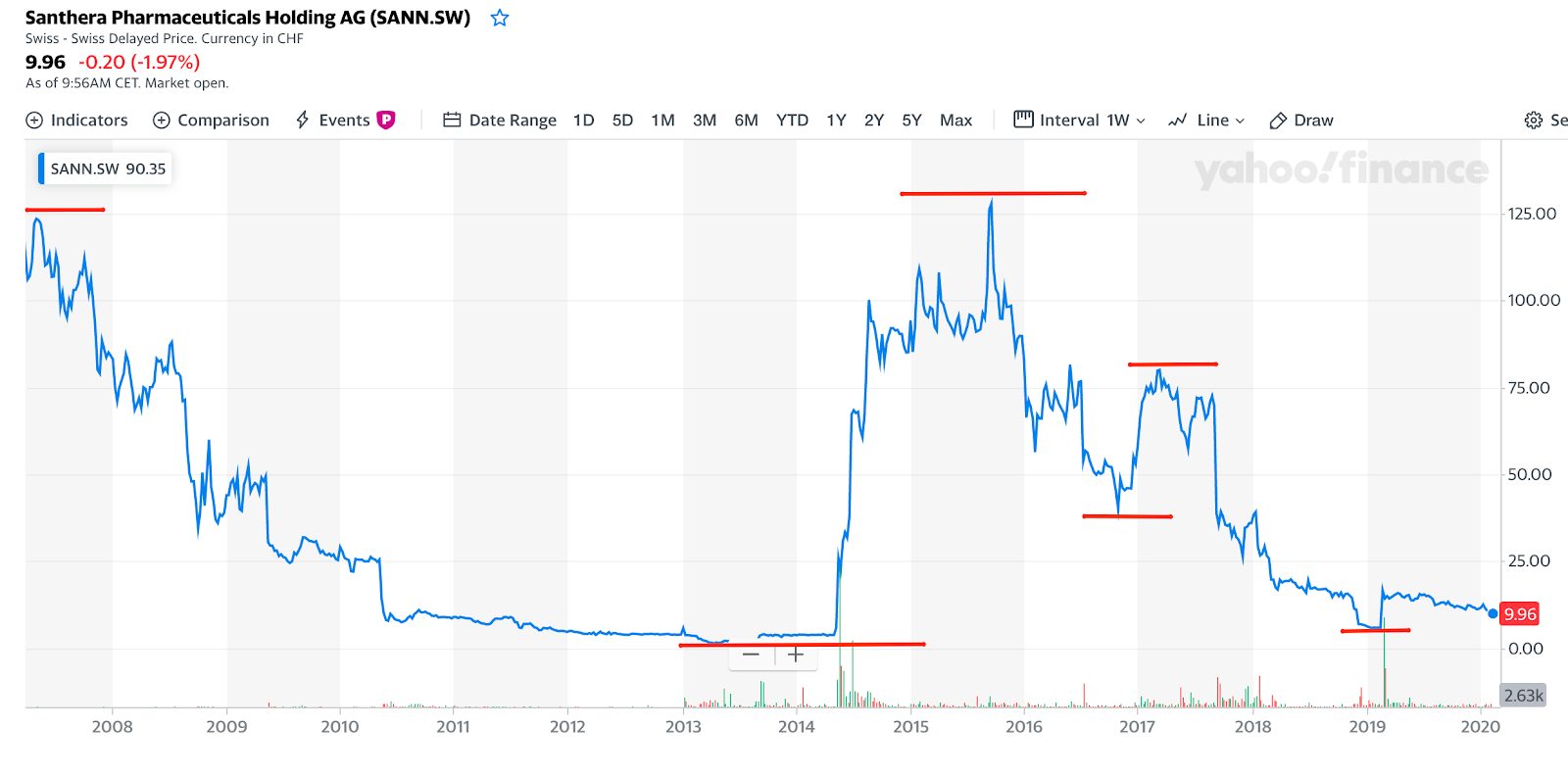

Santhera (SANN)

Last year performance: 70%

Peak-to-trough performance: -97%

A pharmaceutical company that specialises in developing and commercializing drugs against rare neuromuscular and pulmonary diseases. Santhera has a clear niche and a defendable moat as well as a clear profitability pathway.

AMS AG (AMS)

Last year performance: 54%

Peak-to-trough performance: -99%

An Austrian semiconductor and sensor manufacturer listed in Switzerland, AMS produces high specialised integrated sensors with computer boards and can defend its market share via superior technology.

BELIMO Holding (BEAN)

Last year performance: 59%

Peak-to-trough performance: -96%

A leading international manufacturer of actuator solutions for controlling heating, ventilation and air conditioning systems. It is the go-to provider for motor solutions in HVAC.

Lonza Group (LONN)

Last year performance: 54%

Peak-to-trough performance: -92%

Lonza provides product development services to the pharmaceutical industry and is complementary to the thriving Swiss pharma industry.

Novartis (NOVN)

Last year performance: 21%

Peak-to-trough performance: -83%

Novartis is probably one of the most famous Swiss pharma brands in addition to Roche. It also enjoys significant market share in both generic and patented drugs for a wide range of illnesses and is uniquely positioned to combat future diseases.

VAT Group (VACN)

Last year performance: 47%

Peak-to-trough performance: -69%

VAT Group is the world leader in the manufacturing of vacuum valves. A highly specialised industry with stringent quality requirements, VAT is well-positioned to provide quality products in a growing sector.

Busting the investment myths of the old paradigm

You might think that stocks in prominent businesses that performed quite well in recent years could suddenly spiral upwards, like stocks in Amazon or Apple, making you an overnight millionaire. This is a silly fantasy. Think again.

Unfortunately, the market never behaves in an entirely rational manner. As you can see from the table above, there is an inherent volatility to stock value with peaks and troughs par for the course. But if you invested in a small number of similar holdings, your wealth may well be in for a rollercoaster ride.

Here are the most common misconceptions about investing in the stock market:

Myth 1 - Ordinary investors should pick stocks

It has been well-documented that most active fund managers fail to outperform the market. These are well-educated and well-respected individuals who have dedicated most of their professional lives to analysing the market. Yet sometimes they failed miserably. Consequently, individuals who are not at all well-versed with the vagaries of the market should avoid picking stocks altogether, as doing so without the requisite knowledge and skills, is akin to gambling while drunk. It would be reckless. The more sensible approach would be to select a dozen uncorrelated assets (i.e. they move in different directions when given the same set of circumstances) and hold them for the long-term, as illustrated by the significant higher risk-reward ratio here.

Myth 2 - The best time to invest is when stock is rising

This is the most common misconception: whatever goes up in the past must keep going up. Yet there has been very little evidence to indicate this to be true in the market because the value of a stock is largely dependent on its future earning performance (and more importantly expectation of future earning). Given that the future is unpredictable, it is never wise to rely on past performance as an indicator of future ones.

Myth 3 - Index funds are well-diversified, so I’ll hedge my bets

We all know that diversification is the key to reducing portfolio volatility and risk. It is also true that index funds (mutual funds and ETFs) contain a wide range of holdings and offer the perception of diversification. However, upon closer inspection, it becomes obvious that the so-called diversification is simply illusory.

Take the iShares in MSCI Switzerland ETF for example. Our previous analysis revealed their objective is to offer investors diversified exposure to the Swiss market. However, due to its capitalisation-weighting methodology, the top 10 holdings in the fund occupy 67% of the portfolio. And they are only spanning across 3 sectors (financial, pharmaceutical, consumer). In the event of an economic downturn (like the Great Recession in 2008, which impacted all 3 industries simultaneously due to positive correlation), you will see a substantial reduction in portfolio value. This is hardly diversification.

Myth 4 - Always buy the cheapest stocks, surely they’ll rise eventually!

Value investing, a life-long strategy advocated by Benjamin Graham and Warren Buffett, has been in and out of fashion forever. But the principle is pretty simple: buy something valuable cheaply and wait for it to appreciate. Yet when practised in real life, most people remember the “cheap” part but seem to forget that the cheap asset must also be “valuable”. Not everything cheap is valuable and if not carefully chosen, you will simply be stuck with something that has little appreciation potential, thereby squandering your chance of making a return on investment.

Myth 5 - The market is bound to go up one day!

Some time ago, the phrase “time in the market is more important than timing the market” gained traction and investors started blindly believing that, just about any cheap stock they stay invested in, would, given enough time, yield a profit. It is certainly one of the most dangerous fallacies to fall for.

Firstly, this phrase will only be true if you picked a winner. Had you invested in Lehman shares back in 2007 when it was falling, no matter how many centuries you patiently wait, it would never recover.

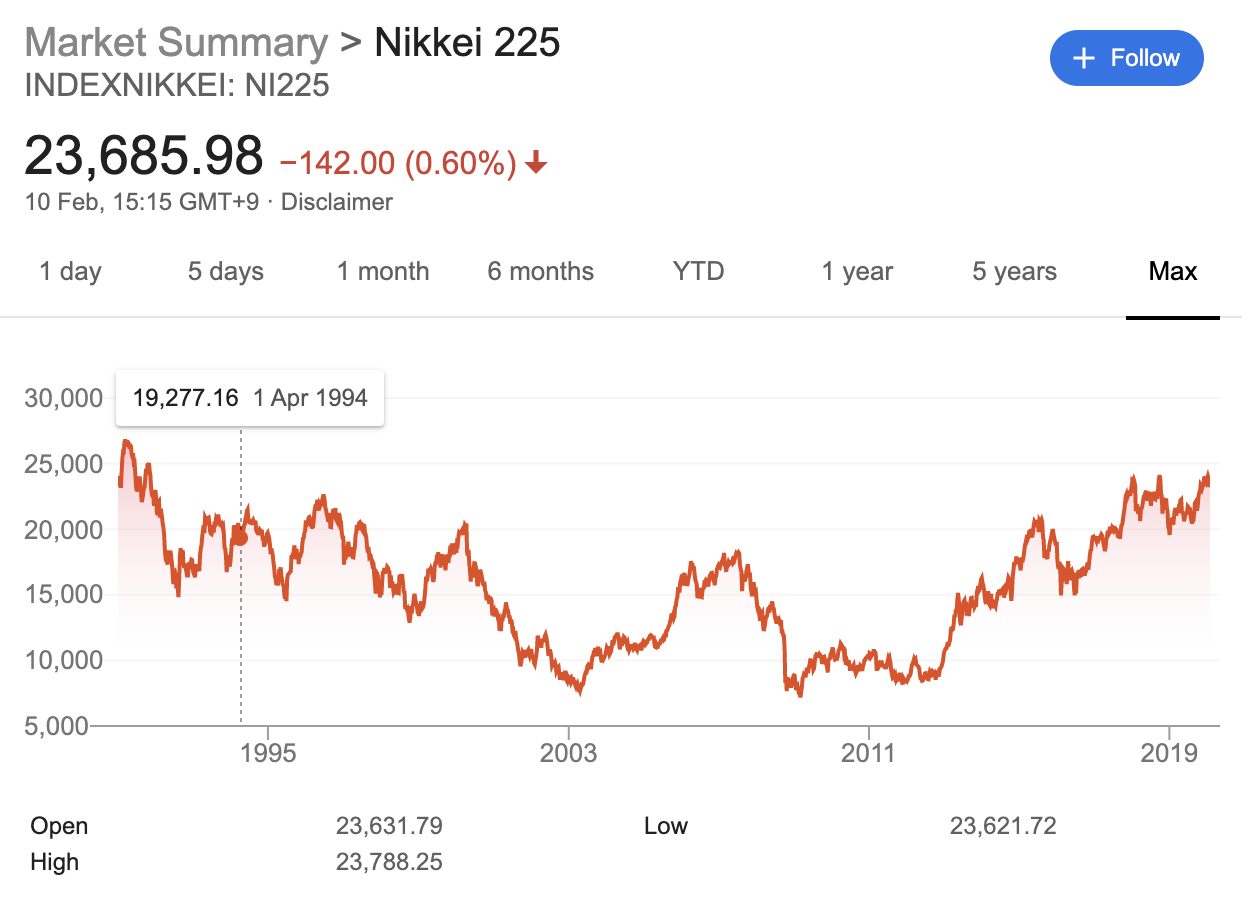

Secondly, even if you had diversified into an index ETF, it is vital that you stick to developed markets like the US or Europe. Imagine if you had invested in Japanese equities in the 1980s, it would have been a full four decades before its valuation reaching anywhere close to the peak.

Japanese stocks never fully recovered after the 1990’s crisis

Rethink your approach to the stock market

In today’s complex world, it takes more than luck to strike gold. You need a methodical approach towards your portfolio to maximise the chance of success. Here’s a list of actions you need to take.

1. Determine your investment objective

What are you planning to use the portfolio for? Are you investing for capital growth or income? How much do you need eventually? These are all the questions you should be asking yourself (and be able to answer) before making any investment decisions. You can use many different types of investment calculators to help you find answers.

2. Figure out your time horizon

You need to be realistic. Most investments need a minimum of five years (preferably ten) to mature. Imagining you could double your money in 6 months is simply unrealistic. Why not have a flutter in Vegas instead. Or maybe start with an investment calculator and a healthy dose of common sense?

3. Construct a diversified portfolio

Proper diversification can significantly reduce portfolio volatility because assets of uncorrelated risks are incorporated. This means when part of the portfolio decreases in value, others may be increasing, thereby smoothing out the performance. A good way to do this is to incorporate stocks that are geographically and sectorally different, as well as including non-equity assets like bonds, real estates, and commodities. Thanks to widespread overvaluations in the public market it may now be worth your while seeking out unconventional assets, to maximise diversification (e.g. hidden gems).

4. Stick to what you know

If you are an expert in fundamental security analysis then fantastic, go ahead. Screen stocks that interest you and make a decision. But for other people who recoil at the prospect of reading through a dozen company reports every day, there is no shame in sticking to ETFs. They are cheap and offer instant diversification. The trick is to understand the composition of each ETF and ensure it is real diversification rather than perceived.

What alternatives are available?

It turns out, picking the next Amazon may not be as easy as you think and it takes a tremendous amount of work to construct a winning portfolio (or even one that doesn’t lose money in the long-term). The obvious next question you will be asking is: what are alternatives to stocks?

Here are some excellent alternatives ripe for plucking

We have compiled a handy table to illustrate the various alternatives to stocks alongside their main pros and cons.

1. Cash

Expected annual real return: -2 to 1%

Pros:

- Instant liquidity

- Preserving nominal value

Cons:

- Erosion of real value due to inflation

2. Corporate and government bonds

Expected annual real return: 3-7%

Pros:

- Can be highly liquid

- Fixed income

- Capital appreciation potential

Cons:

- Default risk

- Interest rate risk

- Inflation risk if coupon is below the inflation rate

3. Private equity (in small local companies)

Expected annual real return: 0 to 100%+

Pros:

- High capital appreciation potential

- Ability to derive dividend if the venture is profitable

Cons:

- Highly illiquid

- High risk of failure

4. Real estate

Expected annual real return: 5-15%

Pros:

- Inherent utility value

- Ability to leverage

- Room for both regular income and capital appreciation

Cons:

- Relatively illiquid

- Very cyclical and subject to local and global economic trends

- High management and transaction costs

Taking real estate as an example, there are 2 main investment approaches: income-driven or capital-drive. In the former, investors aim to maximise the income (or yield) on a given capital input whereas, in the latter, investors aim for the appreciation of land and property price in order to achieve capital gains. In our research, we have consistently identified that the income-driven approach delivers far more consistent returns at lower volatility (risk). This is because rent (based on per sqm or sq ft) has historically been rising consistently at 2-3% per year across major Western cities, therefore gaining exposure to a rising asset class is a sure way to enhance your wealth.

Choosing a surprisingly reliable and healthy alternative

Investing in stocks is a highly effective way to enhance your wealth. However, you will need to be methodical and diligent as well as understand the complicated trade-offs between risk and return. It is definitely not a “get rich quick” scheme and most professional investors will struggle to pick winning stocks consistently in the long-run. This is why you are encouraged to construct a diversified portfolio to manage the downside risk.

It is equally important to understand the true meaning of diversification. Buying fee index ETFs will not be sufficient as many are overweight in stocks with high market capitalisation (some ETFs hold 60% of their value in the top 10 holdings). Diversification means having a group of uncorrelated assets.

On the other hand, there are alternative assets that can complement stocks and it is worth noting them, especially some hidden gems which deliver steady and inflation-beating returns whilst only containing moderate risk.