If you could wake up tomorrow in any fantasy location in the world, where would you be? Instead of being crammed like sardines on a filthy bus or train or stuck in an endless traffic jam, maybe you’d choose to have a leisurely breakfast of fresh tropical fruits and go for a swim in the warm crystal clear sea? Your choice. Your rules. Nobody looking over your shoulder telling you what to do. Surely only billionaires can attain such a luxurious lifestyle every day? Think again.

Because today there’s a rapidly growing cohort of ordinary people who thanks to hard graft, entrepreneurialism or savvy investing, have attained a level of affluence which gives them something priceless: financial freedom.

People who have achieved financial freedom have sufficient passive income (generated from assets rather than labour) to meet their daily financial needs. This is typically achieved through investing in assets that generate steady income streams. One of the most popular categories of assets is called high yield investments.

What are high yield investments?

Yield refers to the annual income as a percentage of the capital committed. If you put in $100 into a bank that pays 3% interest per year, then the yield is 3%.

High yield simply refers to assets whose yield is above the market average. There is not a precise universal threshold that distinguishes a high yield asset from a non-high yield one, but normally anything above 7% is considered to be high yield.

The tabulated examples below are intended to provide a clear understanding of the world of high yield investments in Switzerland. It also illustrates the breadth and depth of such assets.

- Traditional assets

- High yield bonds

- High yield equity (stock)

- Leveraged real estate

- Private business ownership

- Alternative assets

- Crowdfunding projects

- P2P lending

- Specialist hedge funds

- Emerging sectors

- Let’s look at each asset class in detail.

1. High yield bonds

QuickFacts:

Underlying asset overview: lending capital to corporate and governmental borrowers in return for fixed interest payment.

Capital input requirement: CHF 50,000

Yield: 5%+

Capital value fluctuation: can be substantial (+/- 30%) depending on the underlying performance of the bond issuer

Income risks: medium to low

Capital risk: medium to low if held to maturity and the issuer does not default

Payback period: 5+ years

Liquidity: High if the bond is publicly traded, otherwise low

Ongoing management cost: no more than 1% per year

Bonds are debt instruments containing the contractual obligations between borrowers and lenders. It usually contains the following factors:

- Principal amount (par value) - how much was lent to the borrower by the lender

- Coupon rate - the interest rate the borrower must pay the lender for the cost of the capital

- Payment terms - the frequency the coupon will be paid

- Term length - the duration of the loan of which the principal just be relayed at the end (maturity)

- Collateral - any asset used by the borrower to secure the loan against

High yield bonds are simply bonds with above-average coupon rates. This can be caused by 2 factors:

- Inherently high coupon rates

- High effective coupon rates caused by low par value

Every month, hundreds of companies, municipalities and governments issue bonds to finance their operations leaving investors with myriad choices. The strongest factor that distinguishes one bond from another is the coupon rate. All things being equal, the one with the highest coupon will attract the most investment.

There are 2 key internal drivers behind inherently high coupon rates of a bond:

- A robust business model capable of producing high cash flow and thus able to afford to pay a premium coupon rate to attract capital.

- A poorly performing business desperate for capital to ease their short term cash flow requirements, thus forced to pay the premium rate in order to compensate investors for the increased credit risk.

For example, Le Bijou, a network of prime Swiss apartment hotels, issues bonds to investors. The raised funds are used to finance the long-term leasing and refurbishment of apartments in prime central zones in key cities in Switzerland as luxury short-term accommodation. Being a sector that has demonstrated sustained growth and resilience through peaks and troughs, as well as strong underlying fundamentals, this is a robust business model with strong cash flow potential. As a result, it can afford the high-interest rate (ranging from 2% to 5.5% for different issues) to pay investors.

On the other hand, the Argentine government has been running a budget deficit for the past 50 years and defaulted in its sovereign bond 4 times in the past 20 years. As a result, it has a poor credit history and thus when it issued its new round of funding, it needed to persuade investors to entrust it with their capital, by compensating the additional risk they would take on, through high coupon rates.

The second way to achieve high yield is through low par value. Since many of the bonds in issuance are traded on public exchanges (thus highly liquid) and their coupon remains unchanged, a decrease in the par value of the bond would elevate the coupon rate. A bond paying CHF 5 per CHF 100 par value would still pay CHF 5 coupon, even if the par value halves. However, the coupon rate would double from 5% to 10%.

Normally the sudden decrease in par value is caused by material deterioration in the underlying business performance therefore we do not suggest investors touching this category. However, for seasoned and well-informed investors, these can present lucrative opportunities with not only high yield potential but also enormous capital gains.

2. High yield equity

QuickFacts

Underlying asset overview: taking partial ownership of publicly traded companies in return for capital appreciation and income

Capital input requirement: CHF ~1,000

Yield: 7-8% - market average return (Swiss Market Index)

Capital value fluctuation: can be substantial (+/- 30%) depending on the underlying performance of the bond issuer

Income risks: medium

Capital risk: medium to high

Payback period: dividends are usually declared and paid out quarterly or biannually

Liquidity: High

Ongoing management cost: no more than 1% per year

Stock options these days potentially offer far more than simply capital appreciation. With increased knowledge about dividend investing, stocks are quickly emerging as an income-generating asset class in their own right; and potentially a high-yield one too.

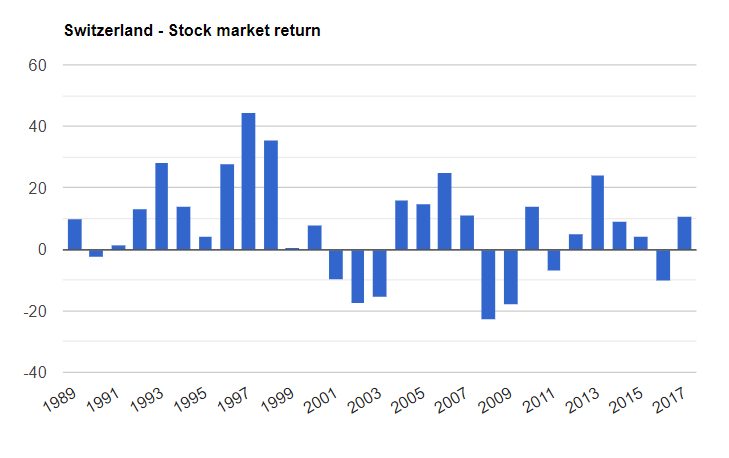

Historical stock market return in Switzerland until 2017

(source; check recent years on Bloomberg)

Income investors buy high-quality blue-chip stocks partially for their reliable and ever-increasing dividend payment. These companies are hugely profitable and the amount of cash profit often exceeds their ability to sensibly invest it. As a result, they return a portion of that back to shareholders. Thanks to sensible reinvesting the dividend and with the effect of compounding, what started off as a small input could quickly grow into a substantial portfolio as illustrated by the Coca Cola case study.

Most blue chips stocks yield at around 2-4% per year. Anything above that is regarded as high-yield, which is often a result of falling stock price (therefore the amount of dividend as a % of the stock price is increased). Investors going down this route are advised to perform detailed due diligence on the company, its financial health as well as the cause behind the recent fall. It is entirely possible that the decrease in stock price is purely a result of overall irrational negative market sentiment and the price will recover. However, it is equally possible that you are simply catching a falling blade.

3. Leveraged real estate

QuickFacts

Underlying asset overview: using a cash deposit and mortgage to purchase properties and then let out on a short or long term basis

Capital input requirement: CHF 50,000 to 100,000

Yield: 5%+

Capital value fluctuation: expected to be relatively stable if invested in the prime areas of in-demand cities

Income risks: low

Capital risk: low

Payback period: 5+ years

Liquidity: low because properties take longer to liquidate

Ongoing management cost: no more than 1% per year

Investors have long favoured real estate as a high yield asset class because of the income stability inherent to properties and the ability to leverage. Properties have intrinsic utilities and values by virtue of their functionality. Furthermore, rental properties provide a fixed and predictable income for the duration of the tenancy. These characteristics also make properties an ideal candidate for collateralisation and thus banks feel comfortable to extend mortgages during purchase.

A mortgage is a form of financial leverage that can amplify return on the equity if the value of the underlying asset rises.

4. Private businesses

QuickFacts

Underlying asset overview: purchasing a minority or majority stake in a business and withdrawal of regular dividends.

Capital input requirement: CHF 100,000+

Yield: variable, can be as high (or low) as business performance allows

Capital value fluctuation: can be substantial depending on the trading performance

Income risks: medium to high

Capital risk: high

Payback period: 5+ years

Liquidity: very low

Ongoing management cost: varies from minimal to substantial, depending on the business

It has been documented that more than half of the people who are financially independent are business owners. It is not surprising given that a sustainably profitable business is a valuable asset that could deliver payback for years to come. Being a business owner means you are responsible for charting out your own destiny (and that of others) and the performance will largely depend on your effort, ingenuity and luck. It is very common for successful small business owners to take high six-figure dividends every year and many of these are of largely passive nature once the right management is in place.

Buying a business, especially in unknown geography can be a risky and daunting task, which is why it makes sense to partner up with someone more knowledgeable. In many cases, it is worth ensuring a local partner with expert knowledge and industry connection remains a minority shareholder (most likely the previous owner). This can vastly reduce the learning curve and minimise the risks.

5. Crowdfunding / P2P lending

QuickFacts

Underlying asset overview: to provide loan capital funding to businesses or individuals in exchange for interest payments.

Capital input requirement: CHF 1,000

Yield: variable, normally between 5-10% per annum

Capital value fluctuation: none, capital will be returned at the end of the term

Income risks: medium

Capital risk: medium to high

Payback period: 1-3 years

Liquidity: very low

Ongoing management cost: none

Crowdfunding/P2P lending is an old concept where the financing requirement of a company or individual is distributed to the masses. The underlying rationale is that it is far easier to raise $100 from 50 people each putting in $2 rather than trying to get 2 people to commit $50 each. The growth of this asset class has been hugely accelerated in recent years from advances in technology and relaxation in regulations.

Entities that turn towards this source of funding tend to be much less established (and thus higher perceived risk) therefore traditional banks are less willing to service them. As a result, their securities must command a higher yield in order to attract capital and that makes them high-yield instruments.

It is very important to assess the quality of the bond before purchasing as there is always a reason why banks refused them loans in the first place. This can be done through credit checks (which is offered by many platforms). If the borrower is willing to pledge assets as guarantees, it is important to check the value and quality of such assets too in order to determine whether the value of the assets can cover the loan in the event of default.

6. Specialist hedge funds / emerging sectors

QuickFacts

Underlying asset overview: a selection of various assets and schemes that are capable of generating high levels of income.

Capital input requirement: CHF 100,000

Yield: variable, normally between 5-15% per annum

Capital value fluctuation: potentially high

Income risks: medium

Capital risk: medium to high

Payback period: 5-20 years

Liquidity: very low

Ongoing management cost: 5%+

This is the most niche asset class and they are sometimes known as alternative assets. They encompass specialist hedge funds that are targeted specifically for high income by investing in high yield bond instruments or distressed debts. There are also schemes which invest in uncommon assets such as freehold leases on land and properties (thus receiving ground rent) and solar panels (by taking a cut of the electricity generated).

These are extremely complex investment schemes which may only be suitable for sophisticated professional investors, due to the high volatility and potential for capital loss. On the other hand, the right product can deliver outstanding returns.