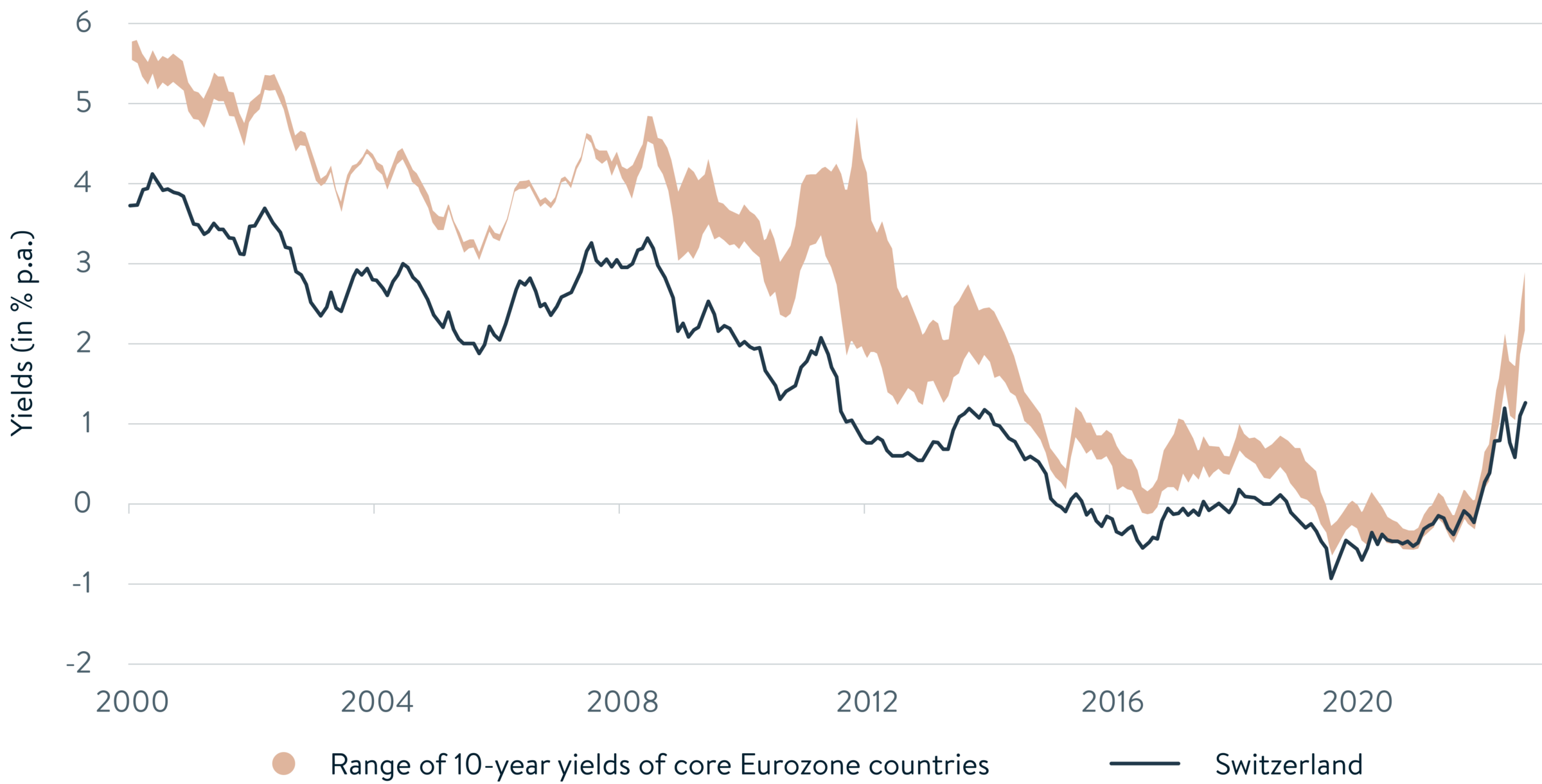

Although rising Swiss interest rates may seem a recent phenomenon, they actually began to reverse a 20-year downtrend in early-2020. That is because the market, particularly the government bonds market, recognized that the era of ultra-low interest rates would come to an end once the world emerged from the coronavirus pandemic. As economic activity bounced back, inflation was expected to increase, leading to a rise in interest rates.

Once again, the market has proven to be a reliable predictor of the future trend in inflation and interest rates.

Yields on European and Switzerland 10-year government bonds (in % p.a.)

Source: Credit Suisse

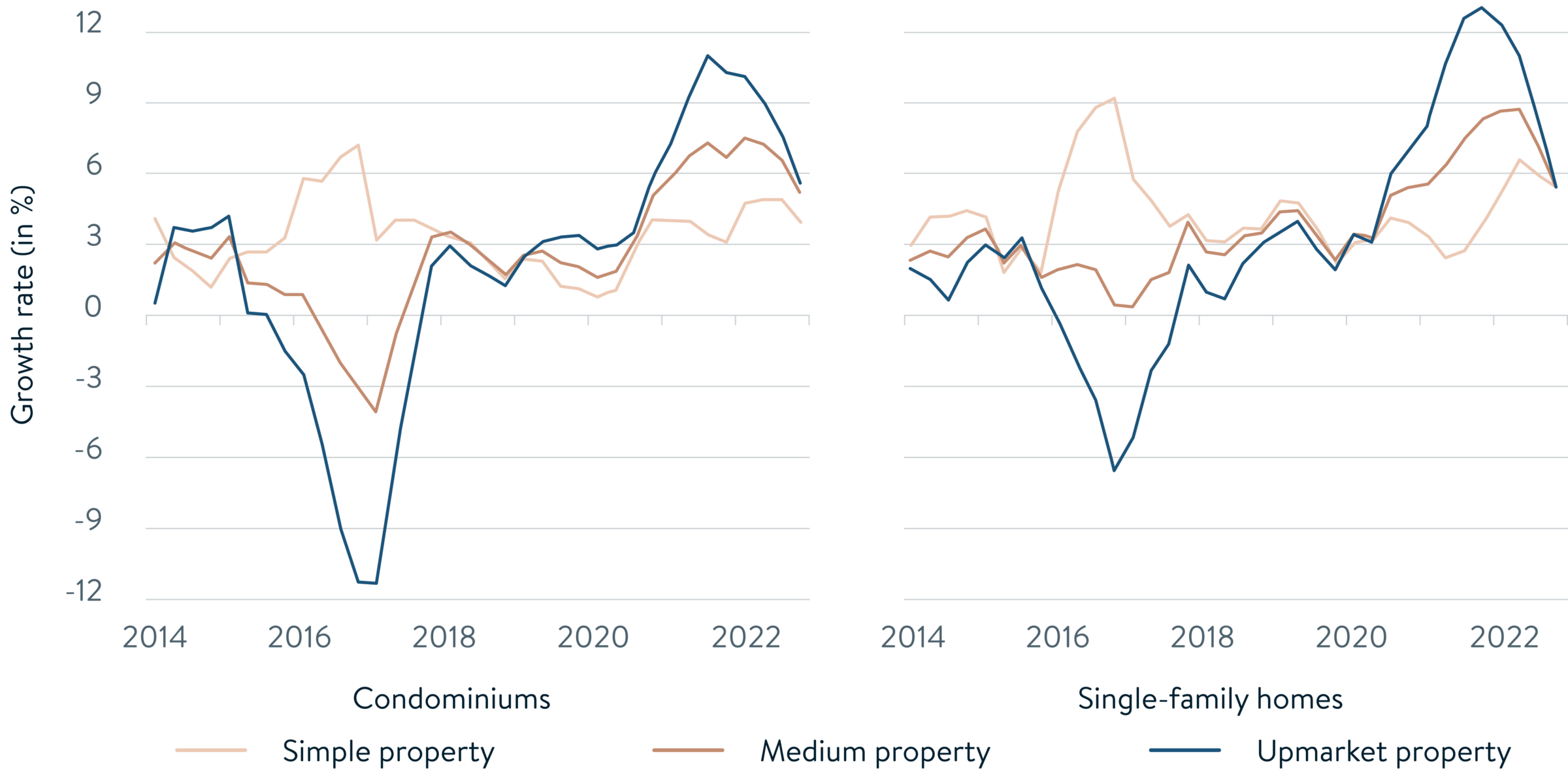

Despite the widely-held belief that interest rates play a significant role in determining Swiss residential real estate prices, these prices continued to soar until the last quarter of 2022, when growth slowed considerably.

Annual growth rates on Switzerland real estate by price segment

Source: Credit Suisse

Therefore, one may ask if investors’ borrowing costs are no longer affecting real estate values. In reality, since 2020 and after adjustment for inflation, the cost of borrowing for house purchases has actually fallen dramatically. With inflation at 3.4% and 10-year fixed-rate mortgages available at 3.08%, the Swiss house-buyer can borrow at a slightly negative real interest rate, meaning net of inflation.

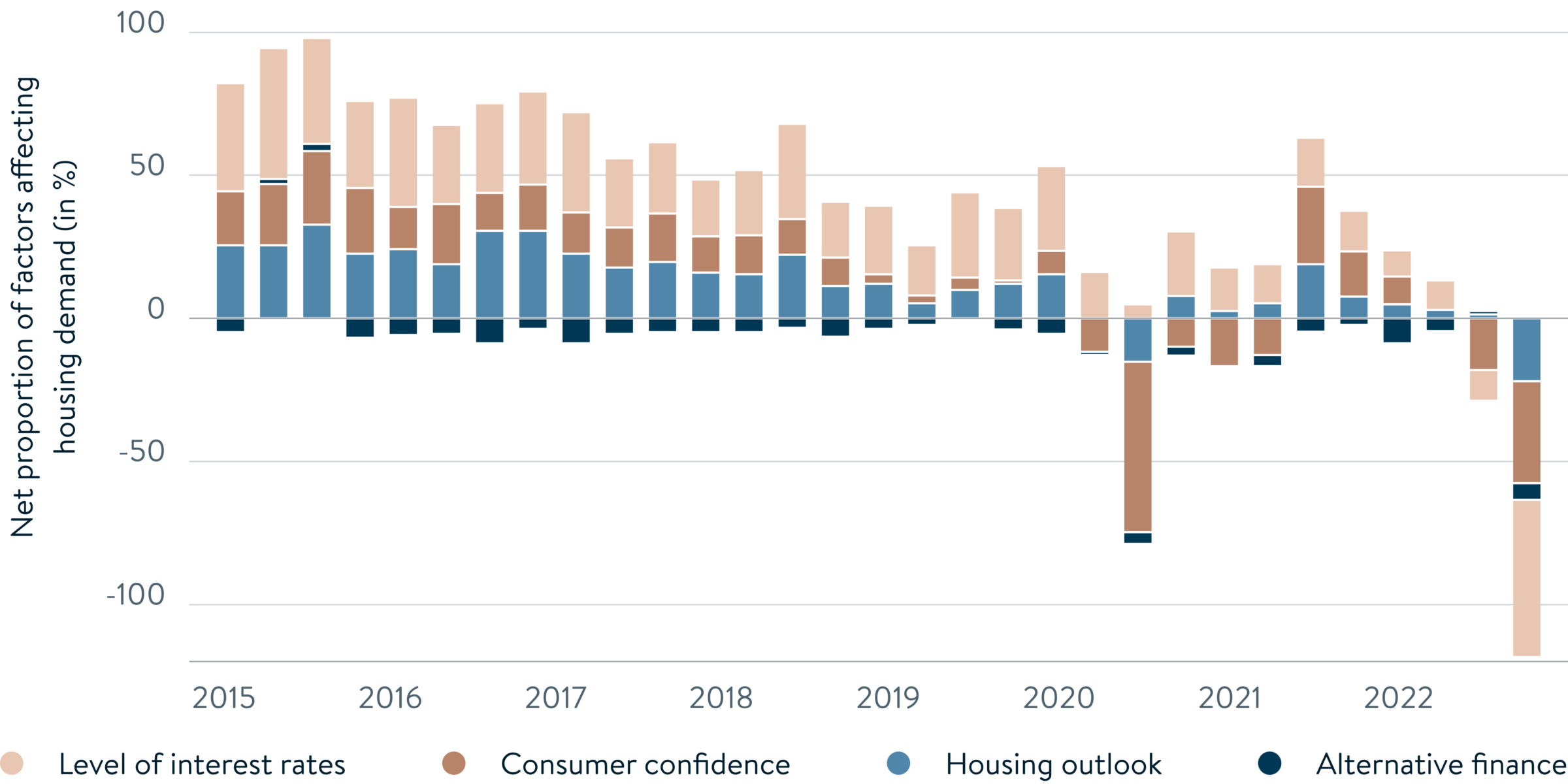

Surely, therefore, house prices in Switzerland should now be roaring ahead, not running out of impetus? However, it seems that interest rates are not the only determinant of value in the Swiss housing market, perhaps, not even the most important. As the next chart shows, buyers’ levels of confidence in both the housing market and the broader economy have been almost as influential, and sometimes the dominant factor. While the data pertains to the Eurozone, it is generally applicable to all residential markets.

Factors that drive the demand in the Eurozone housing market

Source: Financial Times

Nonetheless, The Financial Times suggests that the current downturn is “driven by higher interest rates.” At Le Bijou, we believe that this is an oversimplification based on the evidence provided in the newspaper’s own chart.

That view is further supported by the experience of the 2020 pandemic lockdowns when house prices plummeted almost everywhere, despite ultra-low or even negative interest rates. The chart attributes that downturn to a sudden and sharp collapse in buyers’ confidence. In the current weakness, low confidence is only a little less significant than high interest rates.

Furthermore, as already noted, real interest rates after adjusting for inflation are negative, implying that lenders are effectively paying borrowers. As a result, borrowing costs should not be a significant factor in house prices at present. However, the fact that they are, is due to misperception and, as we shall see later, fear.

One aspect that The Financial Times did not consider is quantitative easing (QE). This was an unprecedented attempt to avoid a recession after the Great Financial Crisis (2007–08) and during the 2020 coronavirus lockdowns. Between March 2009 and March 2022, central banks actively supported their faltering economies by purchasing almost USD 20 trillion in bonds and other securities.

This level of generosity virtually boosted every asset class to new price peaks, including residential real estate. The average cost of a single-family home in Switzerland has risen by 44% over the last 10 years and has more than doubled since 2000.

Since early-2022, central banks have slowed down or even stopped the pace of QE. In some cases, they have begun to unwind it by allowing some of the bonds to mature without being replaced, a process known as termed ‘quantitative tightening’ (QT).

While rising interest rates is an inherent part of QT, the underlying aim, particularly in the US, is to induce a recession in leading economies. However, given the continuing strength of consumer confidence in Switzerland and the US, it is hoped that the recession will be short-lived and shallow.

The outlook in the EU is similarly optimistic, while Swiss economic growth is projected to slow down in 2023, but it is not expected to enter a recession.

These observations suggest that interest rates are unlikely to be a major concern for Swiss real estate prices in the current year. Instead, buyer confidence appears to be the dominant factor, which is difficult to predict due to the influence of unquantifiable factors like the length and outcome of the war in Ukraine, energy prices, and even the weather.

The war in Ukraine is likely the most important factor but is also a two-edged sword. On one hand, the longer it continues, the more buyer confidence will be restrained, if not depressed. On the other hand, a swift resolution in favor of Ukraine would boost confidence, but the resulting surge in consumption and inflation will prompt the Swiss National Bank to increase interest rates further.

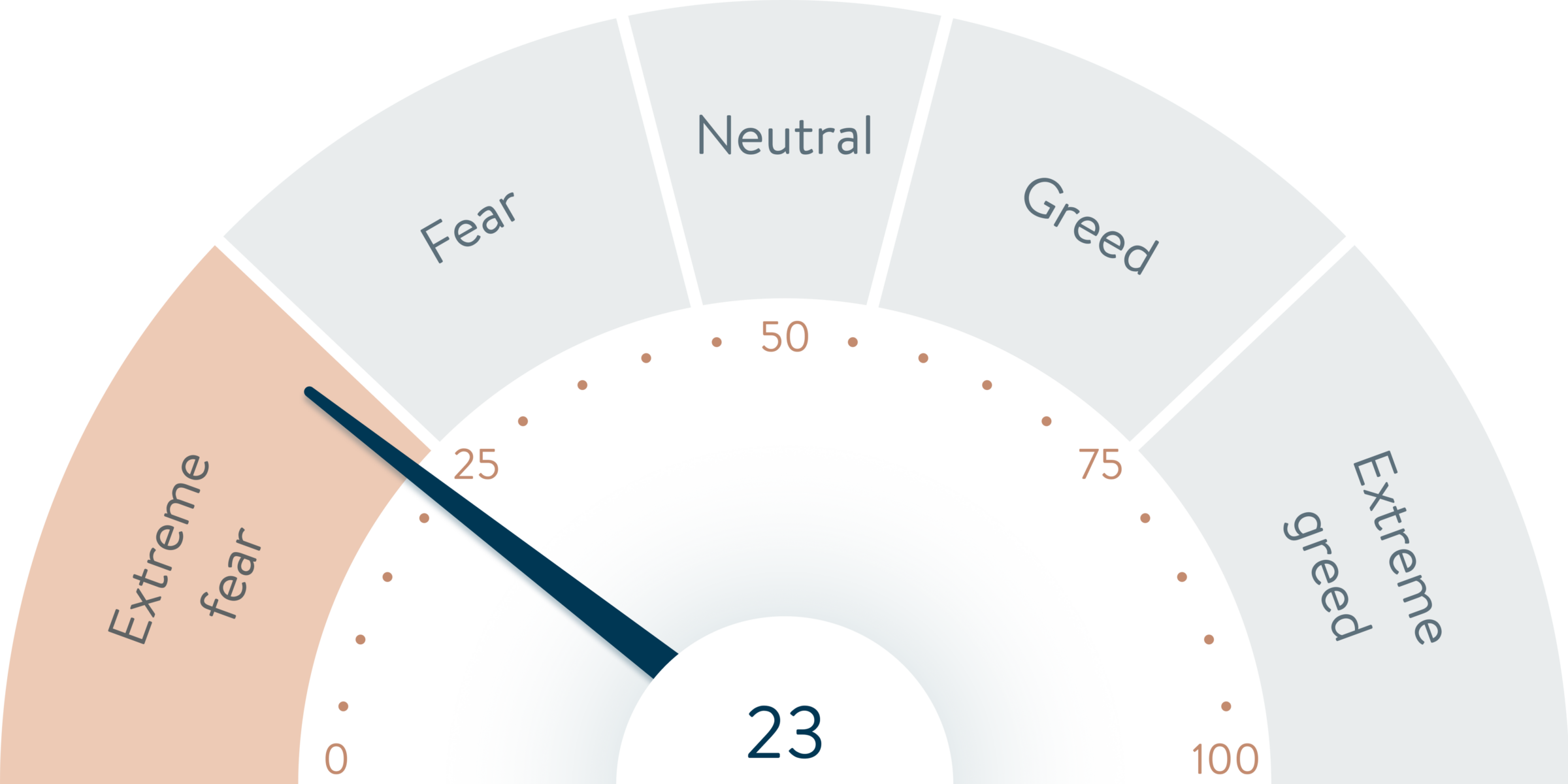

Does all of this make Switzerland's real estate unattractive currently? There is certainly a lot of fear, as indicated by the latest reading of CNN Business’s widely-followed Fear and Greed Index. The index measures a combination of various trends in the US stock market and is relevant for investors in any publicly-traded asset class, including real estate, due to the market’s global investment sentiment dominance.

Fear & Greed Index as of March 2022

Source: CNN Business

The current reading is extremely good news for real estate buyers because, in the words of Warren Buffett, chairman of Berkshire Hathaway, Inc., and hailed as the greatest investor of all time, any long-term investor’s proper goal is “to be fearful when others are greedy, and to be greedy only when others are fearful.”

And this is the exact mantra that guides Le Bijou in everything we do.