We are living in turbulent times. There’s an ongoing trade war between the world’s top two economies - China and the United States; Iran is restarting its nuclear program; the war in Yemen is still waging; North Korea continues to test the patience of the international community by pursuing its nuclear ambitions. These developments represent significant threats to the world order. All it takes is a lapse in judgment with one individual and we could be plunged into chaos and horrific scenarios not seen since the Second World War.

Why do you need a safe haven?

Today, it doesn’t matter whether you are a successful businessman or a respected executive, the political risks you face are both unpredictable and daunting. What will set you apart is your understanding of such risks and your ability and determination to handle them.

Having the ability to maintain and invest assets in a peaceful and stable country (and ideally being able to obtain residency there) could mean the difference between living calmly and existing miserably. In many instances, it could be a choice between life and death.

What you need is a safe haven - a neutral and advanced country that is insulated from geo-political events, which also has a high standard of living and a strong focus on the well-being of its citizens.

It is no wonder that safe havens are often referred to as the best life insurance money can buy.

The charm of Switzerland

Wedged between France, Germany and Italy, the Alpine nation of Switzerland is a country many have considered to be a safe haven for centuries. It is easy to see why.

Declared neutrality

Switzerland has been a politically neutral country since the mid-15th century. This means that it does not typically take sides during conflicts, which vastly reduces the probability of it being subject to hostile actions. As a result, while other nationshave spent centuries fighting for global or regional hegemony, the Swiss have simply been developing their own domestic economy and minding their own business.

More importantly, Switzerland operates a “people’s army” principle where conscription is mandatory and every person can retain their firearms even after their service. What we effectively have is an 8 million-plus strong decentralised army that makes both external military invasion and any internal rebellion difficult. This contributes immensely to its stability.

Peaceful existence

Switzerland realised early on that declared neutrality is not sufficient to protect itself from conflict. As a landlocked nation wedged between other European powers, it needed a way to maintain its neutrality.

The Swiss found two ingenious ways to do just this:

- Act as a mediator between warring factions: Not only does this approach fits Switzerland’s declared neutrality, but also keeps the country away from any possible tension. After all, who would pick a fight with someone who’s trying to stop a fight?

- Develop a sophisticated banking sector: The Swiss banking industry has built such a respectable reputation that several prominent families, including some from Europe’s royalty and nobility, store their fortune there. To them, Switzerland represents safety. The unintended (or perhaps intended) side effect is that it is in nobody’s interest to attack Switzerland, as doing so would jeopardise one’s own fortune.

Banking protection and secrecy

As the Swiss banking sector evolved, the federal government increasingly intervened to protect its prised industry. Two measures were particularly prominent in its effort to boost confidence in the sector:

- Deposit insurance: Switzerland was the first country to formally establish a nation-wide deposit insurance scheme in case of a bank’s insolvency. This boosted investors’ confidence and encouraged capital inflow.

- Banking secrecy: In Switzerland, it is a criminal (rather than civil) offence for bankers to disclose client data without permission. Consequently, there's a significant disincentive for bankers to breach such a condition, and as a result, Switzerland’s standing as a banking destination grew. Note: Switzerland does have automatic tax information exchange mechanisms with many countries in the world as per CRS guidelines. However, the type of data exchanged is extremely limited and well-defined as per CRS.

Advanced domestic economy

After years of peaceful existence unscathed by wars, the Swiss economy is one of the most advanced in the world, boasting an exceptionally high GDP per capita ($80k in 2017, twice that of the UK and 50% higher than the US). It relies significantly on domestic consumption, and hence is well-insulated against global shocks. For example, the Zurich residential market suffered only a modest drop in valuation during the Great Recession in the late 2000s.

Furthermore, Switzerland enjoys an independent monetary policy and a low debt-to-GDP ratio, which enhances the credibility and stability of its economy.

Special relationship with the EU

As a neutral country, Switzerland is not part of the European Union. However, a series of bilateral agreements means it participates extensively in the European Single Market and is part of the Schengen Area of passport-free travel. As a result, the Swiss enjoy many of the economic benefits of the EU without having to undergo the comprehensive political integration associated with EU membership.

Low tax rates

Taxation rates in Switzerland have historically been low. Currently, the highest band of personal income tax is at 32% in the Canton of Jura. Comparatively, the highest income tax rate is only 12% in Zug. The corporation tax rate has a fixed 8.5% federal component and a variable canton component, with the top total tax rate not exceeding 25%.

Failure to prepare is preparing to fail

Ask anyone who had to successfully flee quickly from approaching armies or unexpected natural disasters, and they’ll you that their successful flight from peril was due to preparations made beforehand in anticipation of impending threats.

When New York City plunged into darkness during Hurricane Sandy in 2012, the Goldman Sachs office building was the only location that had power and could maintain operational continuity. Why? Because it had previously installed and waterproofed power generators specifically for incidents like this.

Benjamin Franklin rightly said: Failure to prepare is preparing to fail.

The same can be said about investing in Switzerland quickly. It is imperative that you start making preparations now if you foresee such a need in the future.

There are two key elements that need to be considered here:

- Setting up a Swiss bank account

- Getting the capital out of your home country and into your Swiss account

Setting up a Swiss bank account

Opening a bank account nowadays can be tedious even for local residents, let alone foreigners, thanks to stringent anti-money laundering regulations. It is therefore essential that you start the process early. It has become standard for banks to perform a KYC (know your customer) verification and request an audit trail of how you accumulated your wealth (also known as an inquiry into sources of funds). In addition to proof of your identity, a Swiss bank will also probably ask you for your purpose of setting up the new bank account. As a result, it is crucial to maintain and submit proper documentation in order to avoid potential delays.

Expected time: Allow 2 months

Steps: Choose the appropriate bank; attend the account opening interview; prepare and send documentation

What you will likely need: Passport, proof of address, proof of assets, sources of wealth

What can be a reason for a delay: Incorrect documentation, failure to pass credit checks, KYC compliance issues on the sources of your wealth

Money transfer to your Swiss account

Getting your money and assets out of your home country might be more challenging. Switzerland itself does not impose capital controls, but many other countries do. It is important to understand the financial rules in your home country and abide by them. Otherwise, this could jeopardise the KYC process at the Swiss end.

Expected time: From 1 week to a few years depending on the amount of money you’re looking to transfer and if capital controls are in place

Steps: Decide on the amount to be transferred; understand the restrictions imposed by banks and authorities; make the transfer

What you will likely need: Recipient bank details; proof of ID, proof of address, purpose of the funds transfer, source of the funds

What can be a reason for a delay: Failure to provide the documentation above to satisfy bank’s compliance team

Asset types that can be invested in Switzerland

Switzerland boasts a mature financial market and therefore it is no surprise that there’s an array of different assets available to investors.

Cash deposit

Overview: Depositing capital in a regulated financial institution in exchange for regular interest payments

Investing completion timeframe: Instant

Capital gains: Nil

Income potential: Between 0-3% p.a. depending on currency and terms

Risks: No risk if the deposit is within the protected limit (currently CHF 100k per individual per bank)

Liquidity: High if instantly accessible, otherwise a penalty might incur

Transaction cost: Nil

Management cost: Nil

Entry barrier: None

Suitability: Suitable as a short-term holding facility for your portfolio dry-powder; unsuitable in the long-term due to the erosion of purchasing power from inflation.

Bond

Overview: Lending capital to corporations or governments in exchange for regular interest payments

Investing completion timeframe: Almost instant

Capital gains: Nil on primary markets; possible on secondary markets

Income potential: Investment-grade bonds trading around 3-5% p.a.; junk bonds at 8%+

Risks: Adverse financial performance leading to debtors defaulting on the loans

Liquidity: Usually high as these loans are publicly traded

Transaction cost: Low

Management cost: Low

Entry barrier: Usually around $1,000

Suitability: Suitable as an income-generating engine of a portfolio

Stock

Overview: Direct or indirect ownership of public companies

Investing completion timeframe: Almost instant

Capital gains: 8-10% per year for an index fund; significant upside with the right growth model

Income potential: 2.5% dividend yield per year

Risks: Adverse financial performance undermines the valuation and threatens dividend payment

Liquidity: Usually high as these securities are publicly traded

Transaction cost: Low

Management cost: Low

Entry barrier: Usually around $1,000

Suitability: Suitable as part of any long-term investment strategy

Real estate

Overview: Direct or indirect ownership of physical properties

Investing completion timeframe: Months if purchasing directly; within one week for indirect purchases

Capital gains: 5-6% per year on average depending on the location and property type

Income potential: 3-5% rental yield per year

Risks: Adverse economic conditions could reduce demand and drive down both price and yield.

Liquidity: Usually low as properties are illiquid; can be partially mitigated through investing in REITs

Transaction cost: Around 3-10% depending on the location

Management cost: 1% of the asset value per year

Entry barrier: At least $20,000 for an entire property or $1,000 per REITs.

Suitability: Suitable as part of a long-term income generation and value- preservation strategy

Commodities

Overview: Direct or indirect ownership of commonly traded raw materials (e.g. gold)

Investing completion timeframe: Almost instant

Capital gains: Highly variable; between -50% to 100%+ depending on the type and timing

Income potential: Nil

Risks: Highly volatile and vulnerable to swings in global demand and supply

Liquidity: Usually high as commodities are publicly traded with transparent pricing

Transaction cost: Low

Management cost: 1% of the asset value per year

Entry barrier: At least $50,000 for physical commodities or $1,000 for commodity ETFs.

Suitability: Suitable as a short-term portfolio hedge against uncertainty

PE/VC

Overview: Direct or indirect ownership of private companies or early-stage businesses

Investing completion timeframe: Months

Capital gains: Highly variable, can be 0% or 10x+ of invested capital

Income potential: Nil

Risks: High uncertainty in business performance (hence return); high chance of permanent capital loss

Liquidity: Low

Transaction cost: Around 3-5% of the transaction amount

Management cost: 1-3% of the asset value per year

Entry barrier: At least $100,000

Suitability: Suitable for sophisticated investors not afraid of permanent capital loss of the invested capital

Examples of Swiss assets available for fast investment

Cash Deposit in Swiss Francs

Swiss Franc is considered one of the world's most stable currencies

Below are the two investment banks that are confirmedly interested in international customers and have fast KYC process:

Swiss Bonds

Swiss National Bank, an institution that governs Swiss treasury bonds

Below are two examples of Swiss corporate bonds:

- Le Bijou Bonds (multiple, up to 5.5%)

- ABB Bonds (multiple, 0.3% - 2.25%)

Additional references:

- List of all Swiss Corporate Listed Bonds

- Vontobel Bond ETF Allocation List - this can be useful to see in which bonds Vontobel invests

Swiss Stocks

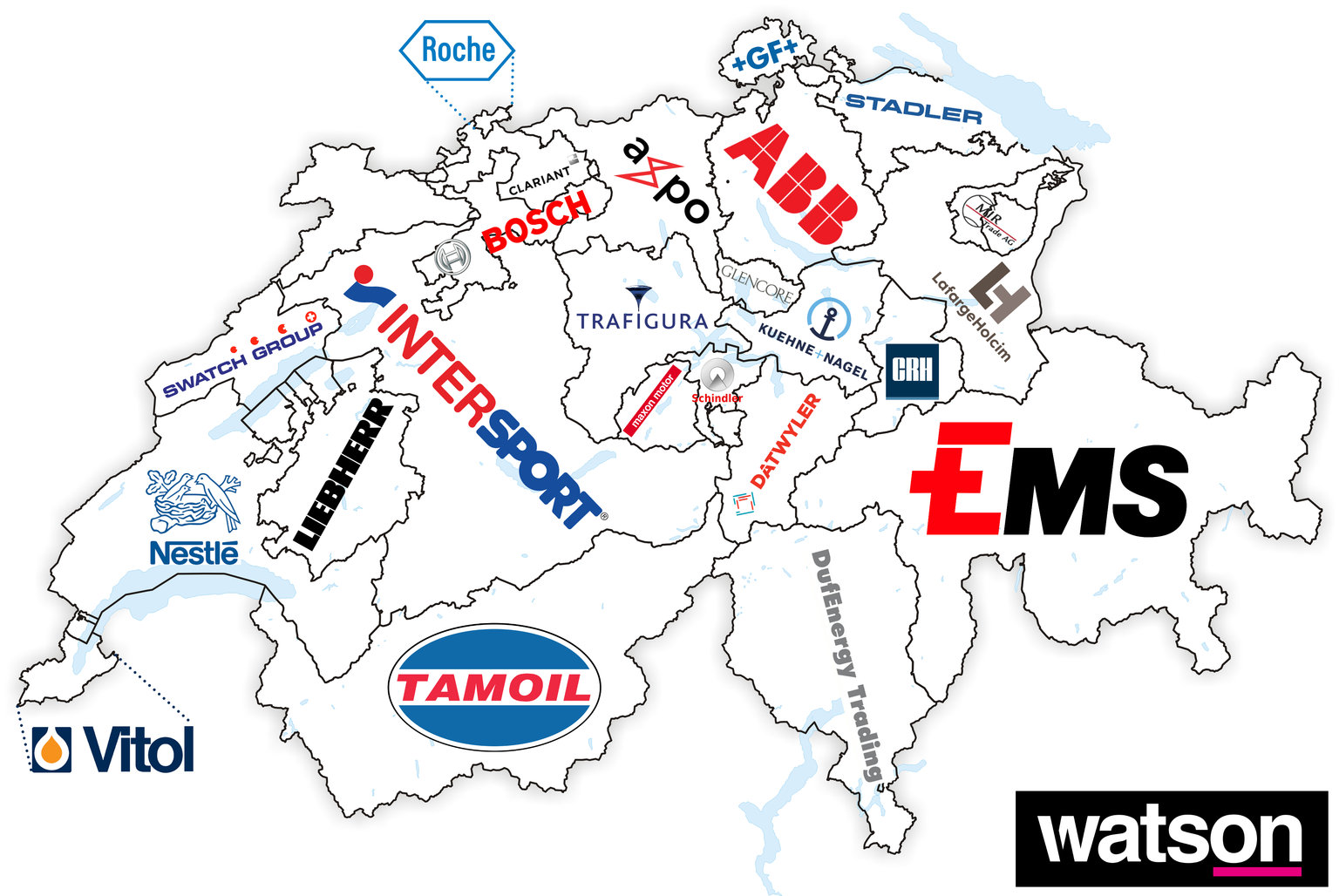

Swiss Industrial Park

If you don’t have a reason to believe you can beat the market in picking stocks, best would be to invest in market indices:

- Swiss Market Index and its performance

- UBS 100 Index - a fund of 100 largest Swiss stocks

Swiss Real Estate

Le Bijou, a hotel that yields up to 7 - 14% p.a.

- Le Bijou Equity (up to 7% - 14% p.a)- fractional ownership of real estate

- List of 140 Swiss REITs

Commodities

Credit Suisse Gold Bars

While gold is believed to be a good instrument to preserve wealth during the financial crisis, this can’t be said about other commodities, which price is driven largely by the industrial consuption, thus can decrease during the financial crisis. That is why we will limit this overview only to gold.

Buying gold in Switzerland is easy with ETFs that reflect the market price of gold:

- Julius Bar Physical Gold ETF

- UBS Gold ETFs

Swiss Private Equity / Venture Capital

Private equity placements take a lot of time and relationships building

The entry ticket varies a lot, although with $100K - $1M you would be able to work only with some of the smallest private equity firms in Switzerland.

Helpful links:

- Top firms that manage Private Equity investments in Switzerland (prepared by Crunchbase, worth registering)

- Linvo AG, an example of a wealth management firm that can manage capital starting from $5M, as well as handle the international funds transfer.

In conclusion

There are many occasions in life where what appears to be a simple and quick endeavor actually requires extensive preparation and a lot of effort. Preparing to be able to successfully invest in Switzerland is a perfect example of such an occasion. But all your hard work will pay off as you will ultimately be rewarded with an unparalleled level of protection and stability for your assets at the end of it the day.

Happy investing!