Invest in a diversified portfolio

Zurich Portfolio

Get access to a well-diversified portfolio of fully operational Le Bijou units managed and operated by our independent local franchisees. Benefit from a strong track record and operational model that has produced 11.57% in returns per year on average since its inception in 2018.

Zurich portfolio

Deal summary

- Access operational locations like Bahnhofstrasse 18, Lintheschergasse 23, Limmatquai 80, etc.

- Benefit from a strong track record and a well-diversified, growing portfolio

- Completely operational franchise with independent management

- Reliable financial forecast due to operations for over a decade, since 2018 for OCZH AG

Locations: Bahnhofstrasse 18, Limmatquai 80, Lintheschergasse 23 and more.

Now open for institutional & private investors

11.57% p.a.

ROI per year

Before deciding on an investment, read the individual risk warnings carefully and consult a trusted financial expert. As for every investment, also real estate investments can include (complete) loss of the invested capital. Please note, that historical or projected performance information is not a reliable indicator for future earnings or losses.

Return calculator*

1Target return: Please note that projected performance information is not a reliable indicator for future earnings or losses. The calculations are based on the historical results of similar projects. The calculated returns are based on the annual ROIC (return of invested capital).

2Investments above CHF 100'000 can access A-shares which offer a higher performance due to lower placement costs.

3Target return: Investments via a saving plan benefit from free leverage during the payoff terms of the purchased shares.

The le bijou way

Before we get into it,

let us explain how we work.

Investing in real estate traditionally means buying a property to let it to commercial or residential tenants. While this may create a steady income, the so-called "buy to let" approach doesn't unleash the property's full earning potential.

We see real estate differently and turn buildings into autonomously operated cashflow powerhouses. To do so, we have developed an operating model that has outperformed traditional real estate investments for over a decade by rigorously automating processes and using modern tech to eliminate complex operations.

Sleep

Short term hotel bookings

Our apartments can be booked just like a hotel, night by night. As our offering is in the premium segment, guests are ready to pay a five-star rate to stay at our properties.

Live

Long term residential tenants

Instead of finding, furnishing, and decorating your place, more and more high-earners decide to use "living as a service," which offers more flexibility and a fully managed lifestyle.

Connect

Corporate and private events

Top-tier brands, corporations, and individuals book our units to host exclusive gatherings, events, brand presentations, meetings, and incentives.

Invest in a diversified portfolio of Le bijou projects

Zurich offers unique benefits over other destinations in Europe

With an investment in the Zurich portfolio, you benefit from one of Europe's most advanced, sought-after destinations. Zurich has one of the world's highest RevPAR (revenue per available room), high rental demand, excellent infrastructure and life quality (usually top 1 or 2), and a high density of top-tier international corporations.

1

AAA+ Location

Our buildings are always located in exceptionally outstanding and central locations. The Zurich portfolio includes top addresses such as Bahnhofstrasse 18, Lintheschergasse 23 (10 steps away from the main train station), Limmatquai 80, and more.

2

Fully operational

The Zurich franchise acquires fully developed and operational Le Bijou units past their ramp-up phase. This enables shareholders to benefit from existing and ongoing cash flow without development risk.

3

Independent

The Zurich franchise is operated and managed independently by Le Bijou. This provides investors with default security should Le Bijou go bankrupt. The franchise agreement entails the Le Bijou operating system and marketing.

Key facts

Just like a diamond, each Le Bijou project has its unique benefits and advantages, which are listed below. Please note that the list is not exhaustive and focuses on the main characteristics of the opportunity.

Zurich has a well-diversified visitor base and one of the most stable economies in the world. As Le Bijou targets short-term hotel guests, long-term high-margin residents, and event clients, Zurich offers an ideal platform. It is both an attractive tourist destination and an internationally established business hub attracting talent, business travelers, and top-tier brands.

Throughout Switzerland, Zurich is the city with the most hotel overnight stays. Over 8% of all overnight stays in Switzerland take place in Zurich. Of 79.8% of all overnight guests who travel to Zurich from abroad, only 20.2% are Swiss. Over 15% of all overnight stays in Switzerland take place in the touristic region of Zurich, consisting of the subregions Baden, Winterthur, Zug, Lake Zurich, and Zurich. Germany is Zurich's most important foreign source market, followed by North America and the UK. Together they make up around 40% of all overnight stays.

Zurich has one of the world's highest RevPAR (revenue per available room), and especially the city center has low to no vacancy for long-term tenants. Le Bijou properties are located within walking distance of international banks, tech companies, and other top-tier corporations.

Zurich is one of Europe's most important financial centers. The finance sector generates around a third of the wealth and a quarter of the jobs in the city. Various innovative businesses and industries form an important basis of the Zurich economy. Biotechnology and life sciences are currently enriching the medical tech sector, while niche markets such as the automotive supplier industry and aerospace, as well as the rapidly expanding creative economy, are enjoying similar success

Switzerland heads the ranking of the most competitive economies in the world. The country managed to navigate the coronavirus crisis more effectively than others. The ranking, which has been compiled by the Lausanne-based IMD since 1989, was previously topped by Singapore. Within Switzerland, Zurich leads the top in terms of competitiveness and growth opportunities.

The Zurich portfolio includes/or will include owned and leased properties. Therefore, investors are less exposed to the interest hikes of mortgages. We are leasing most buildings over a total period of 40 years and therefore do not carry the typical risks of traditional real estate. The functionality of the property (e.g. lift, structure, housing technology, etc.) is the responsibility of the landlord.

Like any Le Bijou apartment hotel, all units are fitted with our self-developed operating system including 24/7 concierge access, iPad minis with our client-facing "James App", as well as automated processes from check-in to check out.

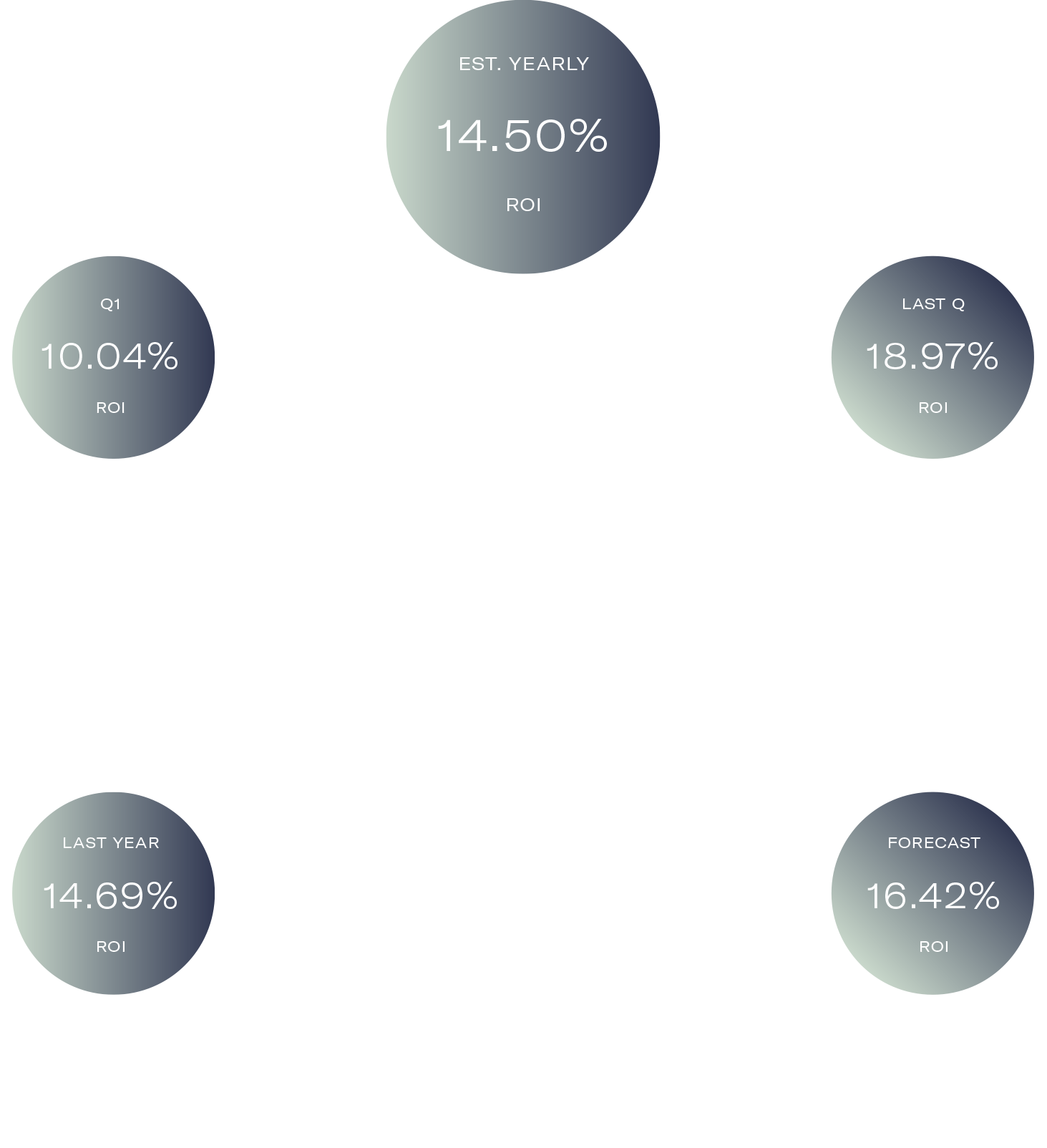

Since its inception in 2018, the Zurich portfolio has performed at an average of 11.57% per year and stayed profitable in both years of the pandemic. The distributable income stayed around 5% per year, not considering value appreciation.

Le Bijou started its operations back in 2011, while some data looks back even as far as 2009. The general misconception that serviced apartments, apart-hotels, or hotel offerings are volatile does not apply to Le Bijou. Our revenues have been stable and predictable during all market turmoil.

The demand for our offering has remained high even during the pandemic. Zurich is one of the most sought-after cities in the world and offers one of the most stable economies, countless international corporations, top-tier universities, and many other competitive advantages.

According to the Citi-commissioned EIU report, the ten most competitive cities in the world are New York (1st), London (2nd), Singapore (3rd), Paris and Hong Kong (joint 4th), Tokyo (6th), Zurich (7th), Washington, DC (8th), Chicago (9th), and Boston (10th).

In contrast to residential properties, Le Bijou projects have highly diversified revenue streams. We serve short-term hotel guests, long-term residents, and event clients.

The Zurich portfolio is formed as a fully operational stock corporation under the laws of Switzerland. Investors enter a Shareholders' Agreement and benefit from independent management. Within the franchise agreement with Le Bijou, the local franchisor licenses our marketing and operating system. Le Bijou charges 6-20% of the EBIDTA, whereas 6% is charged up to a hurdle rate of 8%.

Contemporary Chalet Chic Design

Le Bijou's signature interior design

Our units are equipped and built in our award-winning signature design. Each unit can be connected to a large apartment should bigger groups require it or market demands change.

Managed by bits and bytes

Meet James

Meet James, the face of our virtual concierge service. Backed by augmented intelligence, James can facilitate whatever a guest wants, whenever they want. From 24/7 concierge services and transport to private dining, shopping, or spa services, simply ask, and James gets it done.

Present in every apartment, this concierge technology has the ability to learn from interactions, working away invisibly in the background to create a seamlessly personalized, completely organic experience for every Le Bijou stay.

understanding the difference

Main reasons why Le Bijou beats traditional real estate

The Le Bijou operating model is one of a kind and has shown resilience in extreme situations like the corona crisis or the war in Ukraine. The Zurich Portfolio has performed at an average of 12.5% p.a. over the last three years, despite the sector's worst period ever.

Diversified revenue

In contrast to traditional real estate investments such as multifamily homes or office buildings, a Le Bijou property doesn't rely on a single income stream. Our revenue streams are well-diversified across short-term touristic and business bookings, long-term residential rentals, exclusive corporate and private events, multipurpose income such as home-office, quarantine stays, brand representation, and more.

No rental caps

Residential properties are burdened by increasing regulations and restrictions on rental increases. In most countries, particularly in Europe (and Switzerland), tenants are better off than landlords. Rent nomads can sometimes stay in an apartment for years without paying rent. Rent increases are extremely difficult to enforce and are increasingly capped or lowered by legislation. We are not subject to the Residential Tenancy Act but only conclude temporary accommodation contracts.

Inflation ready

Our clients are not price-sensitive, and dynamic price increases are generally accepted by our guests and residents. Generally, companies selling luxury or premium products struggle less during inflation or recession. Le Bijou can adjust prices dynamically daily. Our corporate clients are prepared to pay an additional margin for our excellent brand reputation and willingness to walk the extra mile.

The Financials

The figures to forecast the project's financial performance are reliable estimates from previous years but are not a guarantee for future earnings.

Since projections are not always accurate, we provide investors with a comprehensive, detailed financial plan. Use the tab "parameters" to change/play around with the projections. Our estimations reflect a conservative approach, and we have left complete buyouts, events, or multipurpose bookings out of the calculations.

| Key metrics: | |

| Return per year (A-Shares, based on ROIC on 4 year average including pandemic): | 11.57% p.a. |

| Return per year (B-Shares, based on ROIC on 4 year average including pandemic): | n/a |

| Equity Multiple A-Shares (MOIC) over 10 years: | 2.21x |

| LTV: | 40% |

| Assumed average occupancy: | 72.5% |

Target returns in % of original equity investment

The liquidity within the franchise company is usually brought forward. Investors realize their returns by selling a portion of the returns back to us at the updated valuation.

Hypothetical investment

CHF 100,000

Total return

CHF 212,000

Skin in the game

Capital sourcing

We participate in the deals with around 40%-50% of our capital. The rest of the required capital will be raised from individual and institutional investors. Please note that we call the capital once you've signed our investment agreement.

Track record

Convincing performance since 2018

The Zurich franchise has produced a high cash flow since its inception in 2018, clearly outperforming the industry benchmark.

The corona crisis has affected distributable profits in the years 2020 and 2021. The results during the crisis would still compete with conventional real estate investments. The chart shows cash-on-cash results and doesn't compare value appreciation.

How to get involved

Investment structure

The franchise entity is formed as an independently managed stock company "AG" under Swiss law to minimize risk exposure and make future transactions easier.

Investment process - no signature is required!

Click on "Start investing" at the end of the page

Follow the guided onboarding process

Hit "send" on the onboarding process to conclude your investment. No signature is required!

You will receive an e-mail with the payment instructions

Investments are due after the contract has been formed online

After we've received your payment, you will receive the assignment of shares via e-mail and post

You will receive frequent updates and investment reports

Questions you might have

-

How do you call the investors capital?

The subscribed investment is due after the onboarding process is completed. The onboarding process doesn't require a physical signature and can be done entirely online. Simply follow the link at the end of this page to initiate it.

-

Is it worth investing early into the project?

We will assign the pro rata value increase based on the valuation of the first ten-year period every quarter. This means that you are rewarded for investing early.

-

What happens if Le Bijou goes bankrupt?

Should Le Bijou not be able to operate any longer, for example, due to bankruptcy, the franchise company will continue its operations. The franchise company is legally not connected to Le Bijou and, therefore, will not be affected by a potential bankruptcy of Le Bijou or any of its projects.

As each Le Bijou property doesn't exclusively depend on a single source of income, management can rent out the property as well on a long-term basis as "regular" serviced apartments. The availability of traditional property managers is high.

-

What is the minimum hold period?

An investment in private real estate is an illiquid asset. We recommend planning with a 10-year hold period. However, our partner Moonshot offers a bulletin board that allows you to sell your holdings after our minimum hold period of 5 years.

-

Am I able to sell prior to the end of the hold period?

Through the Moonshot Bulletin Board, you may have an option to offer your position for sale on the platform at a target sale price based on the net asset value (“NAV”) of the investment at that time, less external fees, and potential discounts for a replacement.

Investments are typically eligible to post on the Moonshot Bulletin Board six months after the initial investor closing (in case of firesale). However, liquidity and pricing are not guaranteed. Before investing, you should assume that you may be required to hold your investment for the duration of Moonshot's hold period.

See important disclosures below.

-

What reports will I receive?

We provide investors with an annual account statement of the investment club. AMC investors will further receive an individual performance report, including the NAV of their investment.

-

What are the main risks to this investment?

The primary risks include lease-up, exit price, and market supply dynamics. We believe these are mitigated by 1) strong demand from guests and tenants based on historical data from our properties in Zurich, 2) conservative exit assumptions, and 3) high absorption rates in the local market.

Please reference the risk factors mentioned on our website.

| Investment parameters: | Above CHF 100'000 | Below CHF 100'000 |

| Instrument: | A-shares | B-shares |

| Minimum holding period: | 5 years (transactions outside our investors network are possible anytime in accordance with the shareholders' agreement) | 5 years (transactions outside our investors network are possible anytime in accordance with the shareholders' agreement) |

| Investment horizon: | 10 years | 10 years |

| Holding period of the underlaying assets: | approx. 40 years | approx. 40 years |

| Placement fee: | 8.5% after holding period via Moonshot investor network | 8.5% after holding period via Moonshot investor network |

| Transferability: | According to shareholders' agreement | According to shareholders' agreement |

| Dividend payout/ repayment of capital contributions: | According to General Assembly of franchise company (OCZH AG) | According to General Assembly of franchise company (OCZH AG) |

| Bankability: | On demand, additional fee min. 0.38% p.a. | On demand, additional fee min. 0.38% p.a. |

| Investor origin: | No restrictions | No restrictions |

What if you require unexpected liquidity?

POTENTIAL FOR LIQUIDITY

Should an investor require earlier liquidity, he can express interest in selling his securities to other investors. We have partnered with Moonshot to access over 7'000 active investors worldwide.

In such case, the investor’s interest in selling will be notified to other investors from the Moonshot Circle on a bulletin board on the Moonshot platform, either within the frame of purchase rights under a common shareholders agreement or otherwise according to the applicable terms.

However, liquidity is not provided or guaranteed; matching between seller and purchaser and the actual sale and purchase transaction are made between seller and purchaser directly without the involvement of Moonshot or the company investing in the respective company.

Performance

Financials are published every quarter, semester, or year. Buy new shares or find a buyer for yours within our community.

Liquidity

We can quickly find a new buyer for your shares should you require unexpected liquidity. Moonshot acts as a "match-maker" via the in-house "Bulletin Board.”

Insights

Know what’s going on before everyone else does. We keep you posted as much as you like. We will keep you informed and provide you with useful information and analysis.

Talk to us

Questions?

We are happy to answer all your questions in a personal meeting or call. Le Bijou representatives are available for in-person meetings all over Switzerland and, upon availability, in Europe.

Schedule a call with one of our representatives to determine if Le Bijou is right for you.

Fabian Coray,

Director Investor Relations

Become an investor

Are you ready to invest?

Like everything at Le Bijou also, the investing process is seamless: Investment contracts can be formed online with a few simple clicks.

Create an account to discover more details and start investing.