Development project

Schauplatzgasse 22, 3011 Bern

Invest in an unbeatable location, next to the Federal Palace in the Swiss capital. The street connects the main train station with the center of Swiss politics, surrounded by many shops, restaurants, boutiques, and top-tier corporations and organizations.

Development project

Deal summary

- An outstanding location that connects the main train station with the Swiss government

- Unique cooperation between Le Bijou, a coworking space, and tech-enabled gastronomy

- Full ownership

- Reliable financial forecast due to our existing property in Bern

Location: Schauplatzgasse 22, 3011 Bern

Now open for institutional & private investors

14.93% p.a.

ROI per year

Before deciding on an investment, read the individual risk warnings carefully and consult a trusted financial expert. As for every investment, also real estate investments can include (complete) loss of the invested capital. Please note, that historical or projected performance information is not a reliable indicator for future earnings or losses.

Return calculator*

1Target return: Please note that projected performance information is not a reliable indicator for future earnings or losses. The calculations are based on the historical results of similar projects. The calculated returns are based on the annual ROIC (return of invested capital).

2Investments below CHF 1M will be made accessible via an actively managed certificate (AMC) which in turn tracks the underlying investment. The performance is lower compared to A-shares due to fundraising and management costs.

3Target return: Investments above CHF 1M can directly join the project company including a board seat

The le bijou way

Before we get into it,

let us explain how we work.

Investing in real estate traditionally means buying a property to let it to commercial or residential tenants. While this may create a steady income, the so-called "buy to let" approach doesn't unleash the property's full earning potential.

We see real estate differently and turn buildings into autonomously operated cashflow powerhouses. To do so, we have developed an operating model that has outperformed traditional real estate investments for over a decade by rigorously automating processes and using modern tech to eliminate complex operations.

Sleep

Short term hotel bookings

Our apartments can be booked just like a hotel, night by night. As our offering is in the premium segment, guests are ready to pay a five-star rate to stay at our properties.

Live

Long term residential tenants

Instead of finding, furnishing, and decorating your place, more and more high-earners decide to use "living as a service," which offers more flexibility and a fully managed lifestyle.

Connect

Corporate and private events

Top-tier brands, corporations, and individuals book our units to host exclusive gatherings, events, brand presentations, meetings, and incentives.

Unique location in the heart of Bern

Own a piece of Switzerland's capital, next to the Federal Palace.

Our project at Schauplatzgasse 22 is located on the street that connects the Swiss government buildings, top-tier political organizations, and the main traffic hub. It is in the center of everything, steps away from countless luxury boutiques, stores, restaurants, and corporations.

With one of the highest streams of daily commuters, this location represents a unique opportunity for a realignment.

1

AAA+ Location

Located on Schauplatzgasse 22, which connects the main traffic hub of Bern and the Federal Palace, this gem represents a high-trafficked opportunity to invest in a prime location in the Swiss capital city "Bern."

2

Our apartments

The building will undergo a complete realignment. The top floors will be operated by Le Bijou, targeting short-term, long term and event clients.

3

Multi-use coworking

On the ground floor, underground, first floor, and courtyard terrace, a high-end coworking will be established, including automated gastronomy offering for coworking and hotel guests and take-away clients.

Key facts

Just like a diamond, each Le Bijou project has its unique benefits and advantages which are listed below. Please note that the list is not exhaustive and focuses on the main characteristics of the opportunity.

We are completely reconstructing the entire inside of the property, which was previously used as a restaurant (ground floor, first floor, terrace) and office (other floors). The architectural feasibility studies have already been performed, and we are ready to hand in our building plans.

Our project company will become the property owner, formed as a Swiss stock corporation (AG). Investors either receive shares directly or as underlying security of an actively managed certificate. This investment offers a unique opportunity to own a piece of prime Swiss real estate right next to the Federal Palace in the Swiss capital.

We plan four to six luxury apartment suites that can be rented short or long-term or that can be converted into additional space for coworking located on the floors above the social club and coworking.

On the ground floor, first floor, and terrace/outdoor areas, our co-operator will present a new combination of coworking, automated, tech-enabled gastronomy, and a social club to extend the day with networking and socializing possibilities.

The entire building can be rented as an event location or converted into almost any type of room imaginable.

Our cooperator Moonshot has an active network of over 7'000 members, many of them frequently traveling within Switzerland. They, therefore, provide a 30% minimum occupancy of their floors. Many full buyouts for events and exclusive venues will further increase and stabilize returns.

The coworking will be offered to Moonshot members and open to public guests. It will offer up to 40-day passes, up to 20 residences, and two meeting rooms bookable by the hour. Clients can also register a virtual address and use the virtual assistant that includes various office services.

Coworkers can use the entire facility and benefit from our automated gastronomy concept, juice and coffee bar, and the social club in the evenings after 6 pm. The coworking will be open 24/7 and offer luxury, high-touch finishes and furnishing.

After 6 p.m., the building becomes a social club that sparks new connections and networking. A space where diverse minds gather and great ideas bloom. Our social club is an expression of this, a salon for creators and explorers to meet, connect and relax in good company and exceptional comfort.

The social club will host events on a regular basis where successful leaders, icons, and personalities will host talks and keynotes.

Located on Schauplatzgasse 22, which connects the main traffic hub of Bern and the Federal Palace, this gem represents a high-trafficked opportunity to invest in a prime location in the Swiss capital city "Bern."

This is the perfect extension to our existing property at Kramgasse 9, 3011 Bern. We have based our financial estimations on four years of operation just around the corner.

A fully automated kitchen serving nutritious bowls will be installed on the ground floor. This modern interpretation of healthy fast food reduces staff costs while providing an all-day service to coworking, hotel, and social club clients.

Benefit from eight different and uncorrelated revenue streams. The building will serve short-term hotel guests, long-term tenants, private and institutional event clients, coworking users, long-term office tenants, restaurant guests, and social club members.

Contemporary Chalet Chic Design

Le Bijou's signature interior design

Our units will be equipped and built in our award-winning signature design. Each unit can be connected to a large apartment should bigger groups require it, or market demands change.

Managed by bits and bytes

Meet James, our virtual concierge

Meet James, the face of our virtual concierge service. Backed by augmented intelligence, James can facilitate whatever a guest wants, whenever they want. From 24/7 concierge services and transport to private dining, shopping, or spa services, simply ask, and James gets it done.

Present in every apartment, this concierge technology has the ability to learn from interactions, working away invisibly in the background to create a seamlessly personalized, completely organic experience for every Le Bijou stay.

The raising combo

Social club, coworking, and gastronomy

Our co-operator in this deal is a global network counting over 7'000 active accredited investors, many of whom are in Switzerland. Moonshot offers its members exclusive access to sophisticated social clubs that are also open to the public.

Providing a minimum of 30% guaranteed occupancy by their Network, Moonshot forms a perfect extension to our apartment units on the top floors.

highly Diversified income streams

Eight revenue streams under one roof

Additionally to the hospitality side of the property, customers can book the coworking space either via day passes or become residents with monthly payments. Meeting rooms are available for rent, and customers can use virtual office services, including the virtual address.

The large terrasse in the backyard creates the perfect venue for catered events and networking. At night, the coworking transforms into a social club serving drinks and nibbles. A 30% occupancy is already provided by our co-operator, which also creates higher occupancy for the apartments.

Timeline

Collecting capital commitments

Executing purchasing right

Building application (requires 3-4 Months, only for interior reconstruction)

Interior reconstruction

Furnishing (FF&E, OS&E, IT)

Soft opening

Fully operational

understanding the difference

Main reasons why Le Bijou beats traditional real estate

The Le Bijou operating model is one of a kind and has shown resilience in extreme situations like the corona crisis or the war in Ukraine. The Zurich Portfolio has performed at an average of 12.5% p.a. over the last three years, despite the sector's worst period ever.

Diversified revenue

In contrast to traditional real estate investments such as multifamily homes or office buildings, a Le Bijou property doesn't rely on a single income stream. Our revenue streams are well-diversified across short-term touristic and business bookings, long-term residential rentals, exclusive corporate and private events, multipurpose income such as home-office, quarantine stays, brand representation, and more.

No rental caps

Residential properties are burdened by increasing regulations and restrictions on rental increases. In most countries, particularly in Europe (and Switzerland), tenants are better off than landlords. Rent nomads can sometimes stay in an apartment for years without paying rent. Rent increases are extremely difficult to enforce and are increasingly capped or lowered by legislation. We are not subject to the Residential Tenancy Act but only conclude temporary accommodation contracts.

Inflation ready

Our clients are not price-sensitive, and dynamic price increases are generally accepted by our guests and residents. Generally, companies selling luxury or premium products struggle less during inflation or recession. Le Bijou can adjust prices dynamically daily. Our corporate clients are prepared to pay an additional margin for our excellent brand reputation and willingness to walk the extra mile.

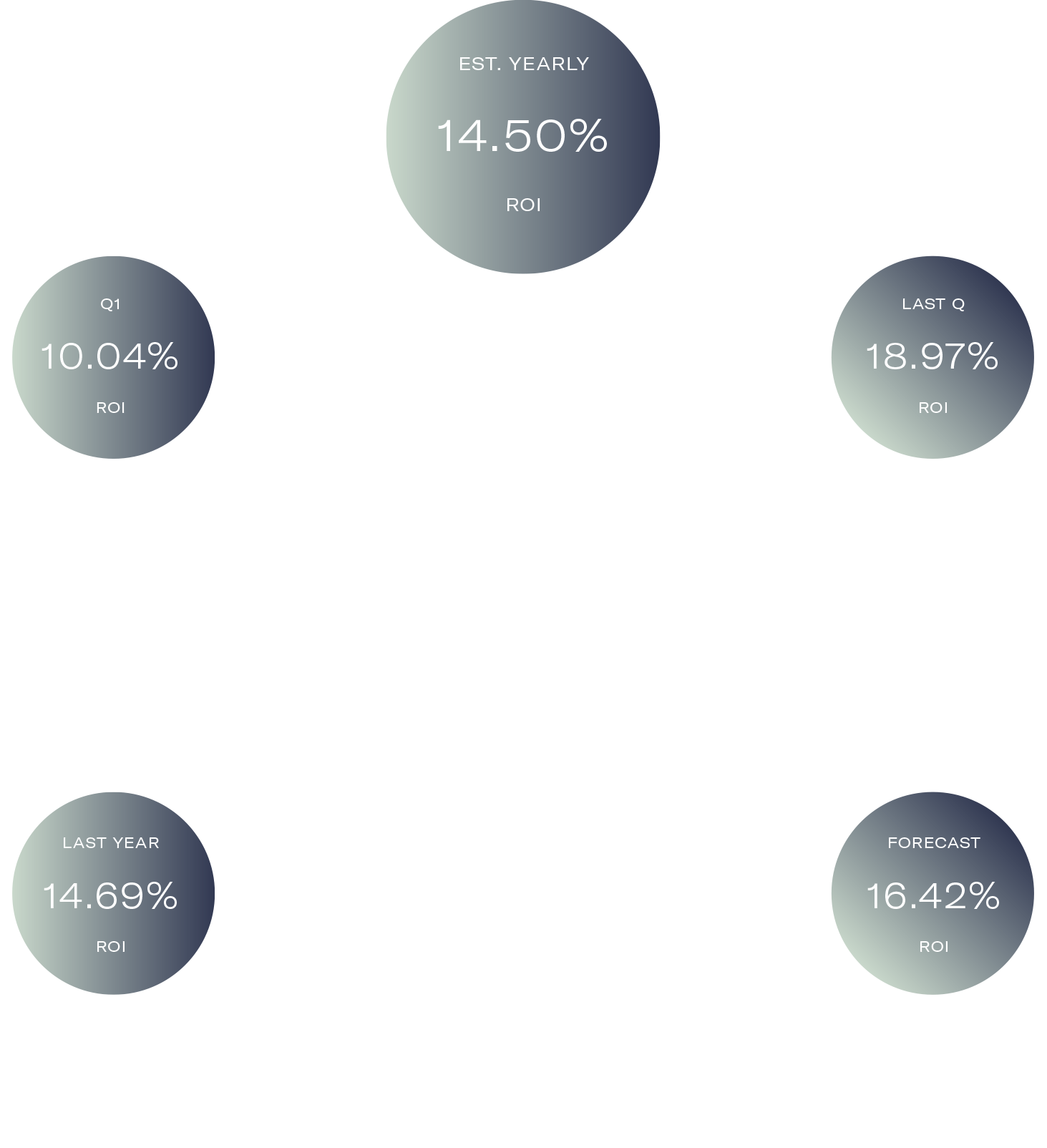

The Financials

The figures to forecast the project's financial performance are reliable estimates from our existing property in Bern. The co-operator provides occupancy of around 30% by his network. All assumptions are based on market rates and an exit capitalization of 8.5%, which is triple of regular real estate in this area (according to PwC).

Since projections are not always accurate, we provide investors with a comprehensive, detailed financial plan. Use the tab "parameters" to change/play around with the projections. Our estimations reflect a conservative approach, and we have left complete buyouts, events, or multipurpose bookings out of the calculations.

| Key metrics: | |

| Return per year (A-Shares, based on ROIC): | 14.93% p.a. |

| Return per year (AMC, based on ROIC): | 10.44% p.a. |

| IRR A-Shares: | 11.30% |

| IRR AMC: | 7.9% |

| Equity Multiple A-Shares (MOIC): | 2.52x |

| Equity Multiple AMC: | 1.76x |

| Overall development budget: | CHF 11.8M |

| LTV: | 35% |

Target returns in % of original equity investment

Hypothetical investment

CHF 1,000,000

Total return

CHF 2,520,000

Skin in the game

Capital sourcing

We participate in the deals with around 40% of our capital. The rest of the required capital will be raised from individual and institutional investors. Please note that we call the capital once you've decided to invest.

How to get involved

Investment structure

The project will be fully operated and owned by a separate legal entity, a so-called "project entity," which is formed as a stock company "AG" under Swiss law to minimize risk exposure and make future transactions easier.

| Investment parameters: | Below CHF 1'000'000 | Above CHF 1'000'000 |

| Instrument: | Actively Managed Certificate (issued by MISP AG, Zug) | Shares of a Swiss stock company |

| Underlaying asset: | B-shares | A-shares |

| Liquidation preference: | Preferred | n/a |

| Minimum holding period: | 5 years (transactions outside our investors network are possible anytime) | 5 years (transactions outside our investors network are possible anytime in accordance with the shareholders' agreement) |

| Investment horizon: | 10 years | 10 years |

| Holding period of the asset: | min. 40 years | min. 40 years |

| Placement fee: | 8.5% after holding period via Moonshot investor network | 8.5% after holding period via Moonshot investor network |

| Transferability: | According term sheet | According to shareholders' agreement |

| Dividend payout/ repayment of capital contributions: | According to General Assembly of project company | According to General Assembly of project company |

| Bankability: | On demand, additional fee min. 0.38% p.a. | On demand, additional fee min. 0.38% p.a. |

| Investor origin: | According term sheet | According term sheet |

Actively Managed Certificate

For investments below CHF 1 Mln

Investors investing CHF 1 Mln and above will become direct shareholders of the project company, which in turn is developping and operating the property.

Investors investing below CHF 1 Mln will invest into an actively managed certificate (AMC) which is issued and managed by MISP AG, Zug, and invests its proceeds into the project company. The actively managed certificate (AMC) receives a slightly lower return due to higher fundraising, investment management, and communication costs.

Swiss ISIN number required?

Bankability on demand

If required, Investors can receive bankable security with a Swiss ISIN number. In this case, investors will carry additional fees, usually min. 0.38% p.a. of the invested capital.

Developed Le Bijou

A hands-free investment

The project company will develop and manage the property. This means investors have a completely effortless and managed experience.

Le Bijou charges a 2% asset management fee, a 2% property management fee based on gross revenue, and an annual performance fee of 6% of the EBITDA.

What if you require unexpected liquidity?

POTENTIAL FOR LIQUIDITY

Should an investor require earlier liquidity, he can express interest in selling his securities to other investors. We have partnered with Moonshot to access over 7'000 active investors worldwide.

In such case, the investor’s interest in selling will be notified to other investors from the Moonshot Circle on a bulletin board on the Moonshot platform, either within the frame of purchase rights under a common shareholders agreement or otherwise according to the applicable terms.

However, liquidity is not provided or guaranteed; matching between seller and purchaser and the actual sale and purchase transaction are made between seller and purchaser directly without the involvement of Moonshot or the company investing in the respective company.

Performance

Financials are published every quarter, semester, or year. Buy new shares or find a buyer for yours within our community.

Liquidity

We can quickly find a new buyer for your shares should you require unexpected liquidity. Moonshot acts as a "match-maker" via the in-house "Bulletin Board.”

Insights

Know what’s going on before everyone else does. We keep you posted as much as you like. We will keep you informed and provide you with useful information and analysis.

Questions you might have

-

How do you call the investors capital?

Direct shareholders (investments exceeding CHF 1 mln)

We usually call your capital through the project's construction process according to our financial planning and capital requirements. Typically, around 10-20% is needed during the planning phase, 50-60% of the capital is needed within nine months of construction, and the remaining 20% is after construction has been completed. The exact capital calls will be communicated from time to time.

Actively managed certificates (investments below CHF 1 mln)

100% of your capital will be called when you sign the contract with us. Based on the valuation of the project after ten years, we will assign the pro rata value increase every quarter. This means that you will be rewarded for investing early.

-

Is it worth investing early into the project?

In the case of AMC investors (actively managed certificates), we will assign the pro rata value increase based on the valuation of the first ten-year period every quarter. This means that you are rewarded for investing early.

-

What happens if the project doesn't get fully funded, fails or cannot be started or completed?

In the case of direct shareholding, we will not call the capital if the project cannot be started, e.a. if it's not sufficiently funded.

AMC investments will still be called, and the raised funds will be used for another deal-by-deal investment. The investors will also be compensated by an increased valuation of their certificates if the project changes.

-

What happens if Le Bijou goes bankrupt?

Should Le Bijou not be able to operate any longer, for example, due to bankruptcy, the project company will assign a new asset manager for the property. The project company is legally not connected to Le Bijou and, therefore, will not be affected by a potential bankruptcy of Le Bijou or any of its projects.

As each Le Bijou property doesn't exclusively depend on a single source of income, the new manager can rent out the property as well on a long-term basis as "regular" serviced apartments. The availability of traditional property managers is high.

-

What is the minimum hold period?

An investment in private real estate is an illiquid asset. We recommend planning with a 10-year hold period. However, our partner Moonshot offers a bulletin board that allows you to sell your holdings after our minimum hold period of 5 years (according to best-effort and based on demand).

-

Am I able to sell prior to the end of the hold period?

Through the Moonshot Bulletin Board, you may have an option to offer your position for sale on the platform at a target sale price based on the net asset value (“NAV”) of the investment at that time, less external fees, and potential discounts for a replacement.

Investments are typically eligible to post on the Moonshot Bulletin Board six months after the initial investor closing (in case of firesale). However, liquidity and pricing are not guaranteed. Before investing, you should assume that you may be required to hold your investment for the duration of Moonshot's hold period.

See important disclosures below.

-

What reports will I receive?

We provide investors with an annual account statement of the project company. AMC investors will further receive an individual performance report, including the NAV of their investment.

-

What are the main risks to this investment?

The primary risks include lease-up, exit price, and market supply dynamics. We believe these are mitigated by 1) strong demand from guests and tenants based on historical data from our properties in Zurich, 2) conservative exit assumptions, and 3) high absorption rates in the local market.

Please reference the term sheet and additional risk factors mentioned on our website.

Talk to us

Questions?

We are happy to answer all your questions in a personal meeting or call. Le Bijou representatives are available for in-person meetings all over Switzerland and, upon availability, in Europe.

Schedule a call with one of our representatives to determine if Le Bijou is right for you.

Fabian Coray,

Director Investor Relations

Become an investor

Are you ready to invest?

Like everything at Le Bijou also, the investing process is seamless: Investment contracts can be formed online with a few simple clicks.

Create an account to discover more details and start investing.